The Ins and Outs of Moat Investing

Stock selection, a cornerstone of the moat investment philosophy, has driven much of the recent success of the Morningstar® Wide Moat Focus Index.

Nov. 20 2020, Updated 3:33 p.m. ET

Stock selection, a cornerstone of the moat investment philosophy, has driven much of the recent success of the Morningstar® Wide Moat Focus IndexSM (MWMFTR), which has gained over 15% YTD as of May 31, 2016. Of late, consolidation has been king and we’ve seen increased M&A activity.

M&A Activity Can Strengthen Moats

The concept of an economic moat refers to how likely a company is to keep competitors at bay for an extended period of time. Simply put, moat investing comes down to identifying companies that are able to stay one step ahead of the competition. Economic moats are often part of the strategic rationale for M&A transactions and post-acquisition success can be an important factor in moat ratings.

Strategic M&A can be attractive investment themes for moat companies — not only potential takeover targets but possible acquirers as well. Bolstered future return on capital and increased market share have the potential to strengthen these companies’ economic moats and highlights the derived value from their acquisition strategies.

Market Realist – As Morningstar explained above, economic moats (MOAT) refer to any competitive advantages a company might hold and these advantages’ sustainability. Warren Buffett coined the term. Just as moats helped defend and protect the fortresses and castles of old, economic moats tend to protect a company from competition that may eat into its business. The strength and durability of a company’s economic moat go a long way in the company’s ability to fend off its rivals and protect its earnings.

Identifying and investing in companies with wide economic moats can help investors boost their portfolio returns. You should keep several factors in mind while trying to identify companies with wide economic moats. These companies are usually synonymous with solid fundamentals, consistent track records, robust historical performance, difficult-to-imitate competitive advantages, and long-lived competitive advantages.

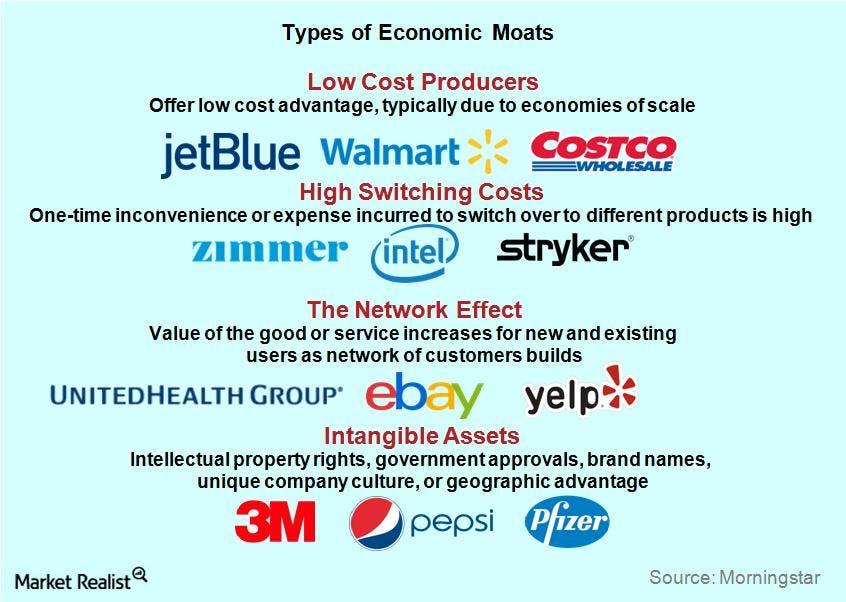

We can classify moats into four broad categories (Source: Morningstar), as you can see in the previous graph.

- Low-cost producers maintain their competitive advantage by providing customers with low-cost products, mainly by providing economies of scale. The biggest example could be the retail behemoth Walmart (WMT). The distinct low-cost advantage and scale efficiency help the retailer price its products attractively and, consequently, enjoy immense operating leverage. Costco (COST), McDonald’s (MCD), and Jet Blue (JBLU) have similar attributes.

- Switching costs occur when consumers can’t easily abandon products and services for substitutes from competitors since the one-time inconvenience or expense to switch is too steep. One example is Morningstar: “Surgeons encounter these switching costs when they train to do procedures using specific medical devices, such as the artificial joint products from medical-device companies Zimmer (ZMH) or Stryker (SYK). After training to learn to use a specific product, switching to another would require the surgeon to forgo comfort and familiarity. Additionally, because the surgeon would have to be trained to use a new, competing product, he or she would also have to contend with lost time and money resulting from not performing as many surgical procedures.” For example, if a particular company uses Intel chips, switching costs could be high.

- The network effect refers to products and services that hold more utility as the customer network builds up. This effect may apply to social networking companies like LinkedIn (LNKD) and Facebook (FB). eBay (EBAY) and Yelp (YELP) are also excellent examples. With the increased customer base, the product’s utility improves.

- Intangible assets could be competitive barriers. Think government approvals, unique company cultures, intellectual property rights—for example, innovator pharmaceutical companies with patents like Pfizer (PFE) with Lipitor—and brand loyalty. For example, Pepsi (PEP) and Coca-Cola (KO) are well-known brands that customers tend to choose over local aerated beverage substitutes. Apple (AAPL) has a loyal customer base.

Long-term investors should identify and invest in companies with wide economic moats to bolster their portfolios.In the next part of the series, we’ll discuss how M&A activity can strengthen moats.