How Did Intel’s Business Segments Perform?

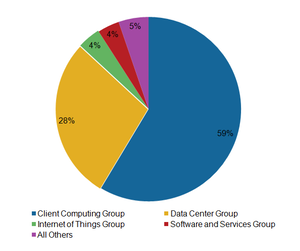

Intel operates through four major business segments—Client Computing Group, Data Center Group, Internet of Things Group, and Software and Services Group.

Oct. 14 2015, Published 12:51 p.m. ET

Intel’s business segments

In the previous part of the series, we saw that Intel’s (INTC) revenue beat the analysts’ forecast. It rose 10% quarter-over-quarter to $14.5 billion. Now, let’s see the key drivers that led to this growth.

Intel operates through four major business segments—CCG (Client Computing Group), DCG (Data Center Group), IoTG (Internet of Things Group), and SSG (Software and Services Group). In fiscal 3Q15, all of the segments reported growth—compared to last quarter. However, on a YoY (year-over-year) basis, CCG’s sales fell while DCG reported double-digit growth.

Client Computing Group

In fiscal 3Q15, CCG’s revenue rose by 13% quarter-over-quarter to $8.5 billion. However, on a YoY basis, the revenue fell by 7%, while the operating income fell by 20% to $2.4 billion. The segment has had to deal with a slowdown in PC sales. The slowdown has forced many companies, including Micron (MU) and IBM (IBM), to reduce their dependence on PCs.

Intel’s sales volume of notebook and desktop chips fell by 14% and 15%, respectively, while the chips’ average selling price rose by 4% and 8%, respectively. This indicates that the company has been catering to the high-end customers in the PC market. If left the low-end customers for its competitor, Advanced Micro Devices (AMD). The latter sells cheaper PC processors.

Data Center Group

In fiscal 3Q15, DCG’s sales rose by 8% quarter-over-quarter and 10% YoY to $4.1 billion. This represented steady growth. The segment’s operating income rose by 9% YoY to $2.13 billion. Intel is a dominant player in the PC server microprocessor market. It had more than 99% share in 2Q15, according to the IDC (International Data Corporation).

Internet of Things Group

In fiscal 3Q15, IoTG’s sales rose by 4% quarter-over-quarter and by 10% YoY to $581 million. Meanwhile, the operating income rose by 4% YoY to $151 million. The company is looking to expand in this area. To help it grow in the data center and IoT space, Intel acquired Altera in June 2015.

Software and Services Group

In fiscal 3Q15, SSG’s sales rose by 4% quarter-over-quarter to $556 million. On a YoY basis, the revenue was flat while the operating income rose by 2% to $102 million.

The iShares Core High Dividend ETF (HDV) invests 3.5% of its portfolio in Intel.