US and Canadian Rail Traffic Fell

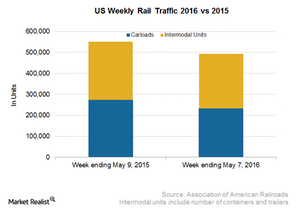

In the week ended May 7, 2016, total US railcars went down by ~233,000, a double-digit fall of 15%.

Nov. 20 2020, Updated 10:59 a.m. ET

US weekly rail traffic

Every Wednesday morning, the AAR (Association of American Railroads) releases the weekly rail traffic data for the previous week. The latest report is for the week ended May 7, 2016. In this week, the total US railcars went down by ~233,000, reflecting a double-digit fall of 15% from 273,500 units in the week ended May 9, 2015. Last week, the US intermodal traffic slumped by 6.4% to 260,000 units from ~278,000 units during the same period in 2015.

Three out of ten carload commodity groups posted volume growth in the week ended May 7, 2016. These are miscellaneous railcars, chemicals, and grains. The commodity groups that posted a fall in the reported week were coal, down by 33.5%, followed by petroleum products and metallic ores and metals products.

Canadian and Mexican rail traffic

In the latest reported week, Canadian rail traffic recorded a decline in both railcars and intermodal. They reported a fall of 17% in railcars in the week ended May 7, 2016, compared with the corresponding period in 2015. These rail carriers recorded a fall of 4.5% in the intermodal traffic units in the latest reported week of 2016, compared with last year.

In the reported week, the Mexican railroads’ intermodal offered some respite. Their volumes of intermodal units went up slightly by 1.7% in the reported week of 2016. However, railcar volume fell by 3.5% in the same week.

North American freight traffic

There are 13 railroads that submit weekly data. These carriers handle about 95% of the total US and Canadian freight traffic. Class I railroads account for the lion’s share of freight rail movement. These are BNSF Railway (BRK-B), Union Pacific (UNP), Norfolk Southern (NSC), CSX (CSX), Kansas City Southern, Canadian Pacific Railway (CP), and Canadian National Railway (CNI).

Investors interested in dividend ETFs can opt for the Vanguard Dividend Appreciation ETF (VIG). This All US Class I railroads are part of VIG’s portfolio.

For more information on the previous week’s rail traffic, read Market Realist’s Week Ended April 30: North American Rail Traffic Falls, Mexico Up. In this series, we’ll take a look at all major US railroad’s rail traffic for the week ended May 7, 2016.