Why Is the Median Income to Median Home Price Ratio Elevated?

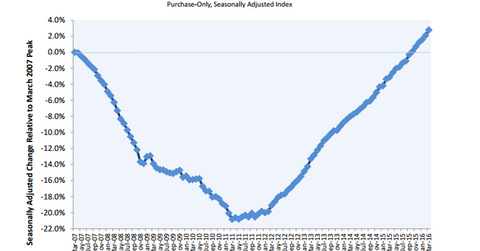

The recent 5.5% year-over-year gain for home prices has put the FHFA House Price Index about 3% above its April 2007 level.

June 1 2016, Updated 10:07 a.m. ET

Home prices broach peak levels

The recent 5.5% year-over-year gain for home prices has put the FHFA (Federal Housing Finance Agency) House Price Index about 3% above its April 2007 level. Strangely, the financial press largely ignored this event. While most indexes show the housing market bottoming out around February 2012, the FHFA House Price Index shows it bottoming out around May 2011. Distressed sales may have dominated at the end of 2011, pushing the other indexes lower.

According to most indicators, real estate prices should be flattening because wages haven’t been keeping up. Although home prices have historically correlated tightly with incomes, that relationship became unmoored with the Fed’s extraordinary easing, which started in the late 1990s.

While incomes aren’t rising, scarcity is pushing up prices. The median-home-price-to-median-income ratio is 4.1x, which is much higher than its historical range of 3.2x–3.6x. That ratio peaked at 4.9x at the height of the bubble.

Granted, low interest rates are playing a part in making expensive homes more affordable. This will probably unwind as interest rates rise. Borrowers with adjustable-rate mortgages are the most at risk.

Implications for mortgage REITs

Big agency REITs such as American Capital Agency (AGNC), Annaly Capital Management (NLY), and MFA Financial (MFA) invest in mortgage-backed securities that the government guarantees. But that doesn’t mean these companies don’t care about real estate prices.

As home prices rise, homeowners who were previously underwater gain the ability to refinance. This increases prepayment speeds. Since they’re underwater, many homeowners hold 2006-vintage and 2007-vintage mortgage-backed securities that have high coupons and low prepayment rates.

As home prices appreciate, these loans will be paid off as borrowers are able to refinance. Prepayment burnout is probably baked in the cake already at these interest rate levels. However, investors in Ginnie Mae mortgage-backed securities are at risk of streamlined VA (United States Department of Veterans Affairs) interest rate reduction refinances.

If you’re interested in making directional bets on interest rates, you could consider the iShares 20+ Year Treasury Bond ETF (TLT). Investors interested in trading the real estate sector as a whole could look at the iShares Mortgage Real Estate Capped ETF (REM).