US Steel Producers Are Complaining about Higher Input Costs

Steel production is raw material–intensive in nature. Iron ore, steel scrap, and coking coal are the key raw materials that go into steel production.

Sept. 21 2017, Updated 4:36 p.m. ET

Higher input costs

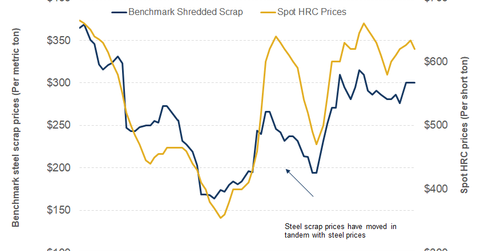

Steel production is raw material–intensive in nature. Iron ore, steel scrap, and coking coal are the key raw materials that go into steel production. Raw material prices impact steel producers in two ways. Generally, higher raw material prices lead to cost-push inflation in steel prices. Something similar happened last year when rising iron ore and coking coal prices lifted global steel prices (MT). Another effect of raw material prices can be seen in steel companies’ input costs.

Steel prices

If steel prices don’t see a commensurate increase in line with raw material costs, steel companies’ profitability, especially those that buy raw material from third parties, tends to be impacted negatively. Looking at US steel markets, steel scrap prices have moved in tandem with steel prices, as you can see in the above graph. Steel prices, especially HRC (hot rolled coil) prices, have been weak recently, but scrap prices have been resilient.

Mini-mills

Higher steel scrap prices are expected to dent mini-mills’ profitability since they rely primarily on steel scrap. Steelmakers using blast furnaces, like U.S. Steel Corporation (X) and AK Steel (AKS), depend on steel scrap less and mainly use iron ore (CLF).

Nucor (NUE), which produces steel in mini-mills, pointed to higher scrap prices as a drag on its profitability. In its 3Q17 earnings guidance, Nucor noted that “Despite high utilization rates at our sheet mills, continued import pressure has not allowed pricing to keep pace with increasing raw material costs during the third quarter of 2017.” Read Steel Companies: What Their 3Q17 Guidance and Estimates Tell Us to find out more about steel companies’ 3Q17 guidance and earnings estimates.

In the next part, we’ll see how imports are impacting the US steel industry.