How Is Boston Scientific’s Geographic Strategy Driving Growth?

Boston Scientific has strategically expanded in these geographies through organic as well as inorganic strategies.

May 18 2016, Updated 9:07 a.m. ET

Geographical profile overview

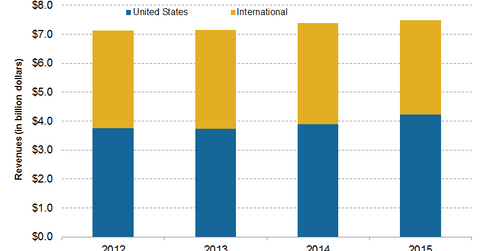

Boston Scientific (BSX) is a global medical device company that generates around 43% of its net sales from markets outside the United States. The company seeks to expand its market share and increase sales through geographic expansion, especially in the high-growth emerging markets.

Boston Scientific has strategically expanded in these geographies through organic as well as inorganic strategies. Boston Scientific maintains research and development facilities in Ireland, India, and China, with six international manufacturing plants. The company also maintains physician training centers in Japan, South Africa, Turkey, France, and China.

Emerging markets growth strategy

Emerging markets generate approximately 11% of Boston Scientific’s total revenues. In 2015, the company’s emerging markets sales grew by around 13%. About 20% of its sales growth was generated from China.

In order to grow this high potential growth market, Boston Scientific (BSX) is focusing on expanding its sales capabilities. It also aims to expand its research and development capabilities in these nations in order to provide localized and more efficient technologies and solutions. Some of the recent initiatives to accelerate emerging market expansion include:

- partnership with Frankenman Medical Equipment Company for physician training and penetration of less-invasive endoscopic technologies in China

- acquisition of interventional radiology business of CeloNova BioSciences to expand the company’s interventional oncology portfolio, particularly in emerging markets

- establishment of Institutes for Advancing Science in Beijing, Istanbul, and Johannesburg, as well as a new manufacturing facility in India

Boston Scientific’s competitors and ETF exposure

Boston Scientific’s peer companies include Abbott Laboratories (ABT), Becton Dickinson (BDX), and Medtronic (MDT). These companies have also established emerging market expansion as a key growth strategy, as these markets present enormous growth potential.

Investors who would like to participate in the growth potential of Boston Scientific (BSX) can consider the Guggenheim S&P 500 Pure Growth ETF (RPG), which has an exposure of 0.96% to BSX.