Why Qualcomm’s Revenues Are Unlikely to Improve in Fiscal 2Q16

Qualcomm earns revenue by selling mobile chips and by licensing its technology to other handset makers. Let’s first look at the core business of QCT.

Sept. 20 2016, Updated 2:02 p.m. ET

Slowing smartphone sales hit Qualcomm’s revenues

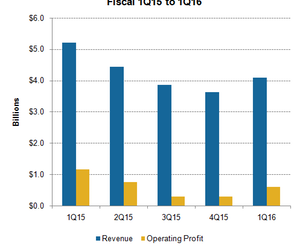

In the previous part of this series, we saw that Qualcomm (QCOM) is likely to post lower revenues in fiscal 1Q16, owing to the weakness in the smartphone market and the changing trend toward mid- and low-end smartphones.

Qualcomm earns revenue by selling mobile chips and by licensing its technology to other handset makers. Let’s first look at the core QCT (Qualcomm CDMA [code division multiple access] Technologies) segment.

New technologies

Qualcomm’s new Snapdragon 820 chipset has secured orders from both high- and low-end device manufacturers. Samsung (SSNLF), Xiaomi, LG, Hewlett-Packard (HPQ), HTC, and Sony (SNE) have opted to use it in their upcoming devices.

Moreover, the company changed its foundry partner from Taiwan Semiconductor Manufacturing Company (TSM) to Samsung, which will build the Snapdragon 820 on its 14nm (nanometer) LPP (low power plus) process. This will reduce costs and improve yields.

Qualcomm has announced the Snapdragon 617 and 430 for mid- and low-end devices, respectively. It’s also witnessing record sales for its Snapdragon 410 and 210 processors.

To cater to future trends, Qualcomm is testing LTE (long-term evolution) technology, and it has started experimental work for 5G networks.

Qualcomm and Intel

While there’s news of design wins, there are also rumors of lost customers. On one hand, there are rumors that Apple (AAPL) will use Intel’s chips in 30%–40% of its iPhone 7s. On the other hand, there are rumors that Intel will lose its largest Taiwanese (EWT) mobile customer Asustek to Qualcomm and Samsung, as Intel has delayed the launch of its 4G (fourth-generation) SoFIA chips.

If both of these rumors are true, Qualcomm may stand to lose, as the trade-off for its key customer Apple would be small customer Asustek.

QCT performance

In fiscal 1Q16, the QCT segment’s revenue fell 21.6% YoY (year-over-year) to $4.1 billion as Apple (AAPL) scaled back its iPhone 6s and 6s Plus production. The segment’s revenue is expected to fall in fiscal 2Q16, as Apple expects to report a fall in iPhone sales. The design wins for Snapdragon 820 may not be able to completely offset this fall.

Qualcomm expects MSM (mobile station modem) shipments to slow from 233 million units in fiscal 2Q15 to 174 million–195 million units in fiscal 2Q16. Although the number of mobile units is falling, the company stated that the RF (radio frequency) content in each smartphone is increasing, and the market is moving toward LTE technology. Both of these trends could bring opportunities for Qualcomm in fiscal 2H16.