An Overview of Casey’s Business Strategies

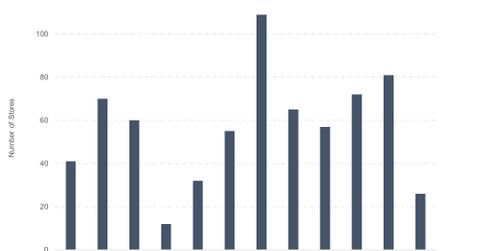

Casey follows both organic and inorganic expansion strategies for its growth. In fiscal 2015, the company opened 45 new stores and acquired 36 stores.

April 22 2016, Updated 9:57 a.m. ET

Strategic overview

In the current section, we’ll discuss Casey’s General Stores’ (CASY) strategies regarding pricing, expansion, distribution, and purchasing.

Expansion strategy

Casey follows both organic and inorganic expansion strategies for its growth. In fiscal 2015, the company opened 45 new stores and acquired 36 stores. For fiscal 2016, the company aims to build or acquire 75–113 stores.

Purchasing strategy

The company purchases food and nonfood items for its stores directly from manufacturers. As a practice (with few exceptions), Casey’s doesn’t enter into long-term supply contracts with any of its product suppliers.

Distribution strategy

Casey’s operates a central warehouse, the Casey’s Distribution Center, which is located near its headquarters in Ankeny, Iowa. Through this distribution center, the company gets all its supplies of grocery and general merchandise to its stores. In April 2014, the company announced plans to build a second distribution center in Terre Haute, Indiana.

Margin boosting strategy

The company continuously looks to grow its food offerings, especially the ones with higher gross margins. Over the years, Casey’s has added various prepared food items to its product line and has installed a snack center in the majority of its stores.

Snack centers sell sandwiches, fountain drinks, and other items that typically have higher gross profit margins than general grocery items. This strategy has helped Casey’s to become a food destination instead of just a fuel destination.

Casey’s and its peers CST Brands (CST), Murphy USA (MUSA), and Kroger (KR) are part of the SPDR S&P Retail ETF (XRT). Together, these companies account for 4.4% of the index’s weight.

Read the next sections to learn about the company’s sales and profit-boosting initiatives.