What Moves Did FDGRX Make Leading Up to 1Q16?

FDGRX’s assets were invested across 394 holdings as of March 2016, two more than a quarter ago. It was managing assets worth $37.8 billion as of March’s end.

April 25 2016, Published 4:03 p.m. ET

Fidelity Growth Company Fund

The Fidelity Growth Company Fund (FDGRX) “normally invests primarily in common stocks of domestic and foreign issuers that Fidelity Management & Research Company [FMR] believes offer the potential for above-average growth. Growth may be measured by factors such as earnings or revenue.”

The fund manager makes use of fundamental analysis, including factors such as the financial condition and industry position of each issuer and economic and market conditions, while selecting securities for the portfolio. Investors should note that this fund is closed to new investors.

The fund’s assets were invested across 394 holdings as of March 2016, two more than a quarter ago. It was managing assets worth $37.8 billion as of March’s end. As of the February portfolio, its equity holdings included NVIDIA (NVDA), Lululemon Athletica (LULU), Keurig Green Mountain (GMCR), Monster Beverage (MNST), and Alnylam Pharmaceuticals (ALNY). These stocks formed a combined 8.4% of the fund’s portfolio.

Historical portfolios

For this analysis, we’ll be considering holdings as of February 2016, as that is FDGRX’s latest available sectoral breakdown. The fund’s holdings post-February reflect the valuation-driven changes to its portfolio, not its actual holdings.

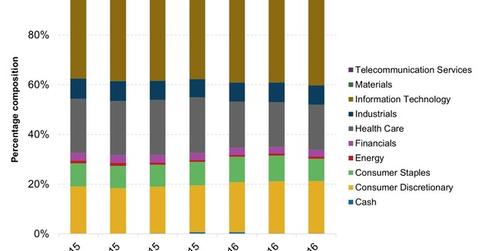

Information technology, consumer discretionary, and healthcare are the core sectors in which the fund invests. All three form more than 15% of the fund’s assets each, with the first two forming close to 60% of its portfolio. The fund manager hasn’t invested in the utilities sector.

FDGRX considers the Russell 3000 Growth to be its benchmark index. Compared to the Russell 3000, FDGRX is overweight in the information technology, healthcare, and energy sectors, while it’s sharply underweight in the financials, materials, and telecommunications services sectors.

In the past year, FDGRX’s fund manager has increased exposure to the fund’s top two invested sectors, information technology and consumer discretionary, while reducing its exposure to the financials, energy, and healthcare sectors. The fund’s portfolio turnover is quite low, which means that the manager has stayed with the fund’s holdings rather than frequently adding or selling off securities. The materials and energy sectors are the exceptions.

What can the fund’s 1Q16 performance be attributed to? Let’s look at that in the next article.