Precious Metals in September: A Review

The negative sentiment toward gold prevailed on Friday, September 29, the last trading day of the month. Gold futures for November expiration fell 0.3%.

Oct. 3 2017, Published 2:12 p.m. ET

September crunch

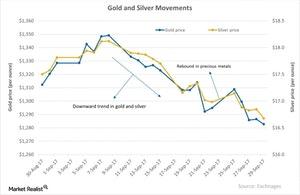

The negative sentiment toward gold prevailed on Friday, September 29, the last trading day of the month. Gold futures for November expiration fell 0.3% and closed at $1,282.7 per ounce. The call implied volatility in gold was at 9.7%—the lowest level in September. (Call implied volatility is a measurement of the fluctuations in the price of an asset with respect to the changes in the price of its call option.)

Gold fell 2.7% in September, making it the weakest month in 2017 so far. Silver fell 4.8% in September, and platinum remained the weakest among precious metals, falling 9.4% for the month. Palladium was marginally low, falling 0.5% in September, but market sentiment toward palladium has been strong in 2017.

One of the important factors playing on precious metals in September was the US dollar, whose rebound was crucial to the tumbling of dollar-denominated metals.

Market speculation about the threat from North Korea and the Federal Reserve’s forecast were both elemental in precious metal price fluctuations throughout the month.

Mining stocks slump

The fall in these metals also led to a fall among mining-based funds like the Global X Silver Miners (SIL) and the Sprott Gold Miners (SGDM), which have now fallen 5.8% and 7%, respectively, on a 30-day trailing basis.

Among the specific mining stocks that have fallen during the past month, Franco-Nevada (FNV), Pan American Silver (PAAS), AngloGold Ashanti (AU), and Hecla Mining (HL) have fallen 5.5%, 7.9%, 5.7%, and 4.6%, respectively, on a 30-day trailing basis.