What You Should Know about Stanley Security’s Business Mix

The Stanley Security business saw a steady decline in the last four years with sales falling from $2.4 billion in 2012 to ~$2.1 billion in 2015.

Nov. 20 2020, Updated 4:56 p.m. ET

Business performance of Stanley Security

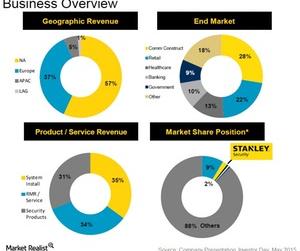

The Stanley Security business saw a steady decline in the last four years with sales falling from $2.4 billion, or 23.7% of total company revenues in 2012, to ~$2.1 billion, 18.7% of total sales in 2015. The primary contributors to the decline were external such as weakness in the housing industry (XHB) in major regional markets and unfavorable currency translations in 2015. Poor conversion in the recurring service and monitoring business in Europe also aided the decline.

Product mix

Stanley Black & Decker’s (SWK) sales under security solutions are split between mechanical access solutions (or MAS) and convergent security solutions (or CSS). 29% of security sales were derived from the MAS business with CSS raking in the rest. The MAS business provides electronic locking solutions such as keyless entry and automatic doors. The CSS business is engaged in electronic surveillance with half of its sales coming from lucrative service and monitoring contracts.

In end-market exposures, the company collects 57%, 14%, and 11% of segment sales from the construction, industrial (XLI), and automotive industries, respectively.

Market position

Security solutions is a highly fragmented industry with companies specializing only in parts of the wide product offerings within the industry. For example, Assa Abloy (ASAZY) is a market leader in door opening solutions and has no presence in the electronics security market. Stanley Black & Decker (SWK) is a major electronic surveillance player and takes the second position in the commercial electronics security market. Stanley Security has a market share of 2%, a full seven percentage points behind the leading Tyco International (TYC).

Tyco International recently acquired Johnson Controls (JCI). For details about the merger, read Johnson Controls: In the Midst of a Transformation.