Lowe’s Revenues: What to Expect in 2019?

For 2019, analysts expect Home Depot (HD) to report revenues of $111.4 billion in 2019—a rise of 2.9% from $108.2 billion in 2018.

May 28 2019, Published 1:30 p.m. ET

First-quarter performance

In the first quarter, Lowe’s Companies (LOW) outperformed analysts’ revenue and SSSG (same-store sales growth) estimates. For the first quarter, Lowe’s posted an SSSG of 3.5%, which beat Home Depot (HD). Home Depot reported an SSSG of 2.5% for the first quarter. Looking at the company’s monthly performance, Lowe’s has reported a significant improvement in its SSSG with -1.4% in February, 3.5% in March, and 7.2% in April.

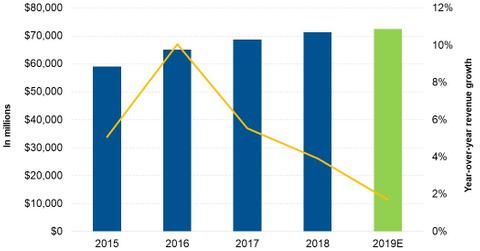

Analysts’ 2019 revenue estimates

For 2019, Lowe’s management expects its revenues to rise 2.0% with an SSSG of 3.0%. Analysts expect the company to post revenues of $72.53 billion in 2019—a rise of 1.7% from $71.31 billion in 2018. The revenue growth is expected to be driven by positive SSSG. However, the lower store count and the company’s decision to exit some of its non-core businesses are expected to offset some of the increased revenues.

Lowe’s is focusing on building improved pricing analytics, improving its operational efficiency, expanding its offerings, increasing its customer engagement, and implementing digital advancements to drive its SSSG.

Lowe’s is digitizing its business processes. The company is also building improved pricing analytics to become more agile, which could offset future cost pressure and protect its gross margins. Lowe’s recent acquisition of Boomerang’s retail analytics platform is expected to help modernize its pricing approach.

Lowe’s has trained 280,000 associates on its smart customer service. The company has implemented 88,000 smart mobile devices in its stores. These devices will provide associates with real-time product data at their fingertips. The change will help associates avoid the risk of leaving the sales floor and losing engagement with the customer.

The company implemented merchandising service teams during the first quarter. The teams are responsible for setting and maintaining end caps, executing off-shelf displays, and making product presentations. Implementing the teams has yielded positive responses.

Lowe’s is working to improve its job lot quantities and product presentation, store level service, and greater engagement to attract more professional customers. All of these initiatives will likely drive Lowe’s sales in 2019.

Peer comparisons

For 2019, analysts expect Home Depot (HD) to report revenues of $111.4 billion in 2019—a rise of 2.9% from $108.2 billion in 2018.