Scrap or Iron Ore: What Drives US Steel Prices?

Even the recent uptick in US steel prices has been accompanied by strength in steel scrap prices.

March 16 2016, Published 1:31 p.m. ET

US steel prices

Raw material prices tend to impact steel pricing also. Steel scrap, iron ore, and coal are among the key raw materials used in steelmaking. Lower seaborne iron ore prices helped Chinese steelmakers, as China relies heavily on iron ore imports.

Scrap prices

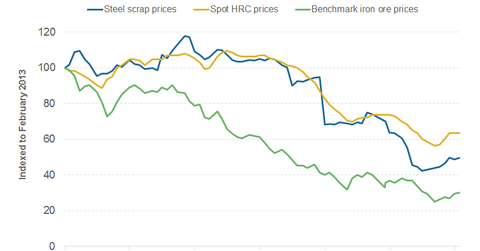

Meanwhile, for US steel producers like Nucor (NUE) and Steel Dynamics (STLD), steel scrap pricing is a bigger driver than seaborne iron ore prices. The graph above shows the movement in spot hot-rolled coil (or HRC) prices plotted against benchmark-heavy melting scrap according to data compiled by the Metal Bulletin. As you can see, spot HRC prices have been moving in tandem with scrap prices. Even the recent uptick in US steel prices has been accompanied by strength in steel scrap prices.

Iron ore

US spot HRC prices have a lower correlation with seaborne iron ore prices as can be seen in the graph above. This is not surprising as US steel mills rely heavily on steel scrap. Even in iron ore, US steel mills either have their captive iron ore mines or buy it through long-term supply contracts. This basically means that US steel prices don’t have much to do with benchmark iron ore prices, at least in the short term.

However, though US scrap prices don’t follow seaborne iron ore prices in the short term, over the medium to long term, changes in alternate raw material costs tend to impact the overall dynamics. Companies can shift between scrap and DRI (direct reduced iron). Notably, last year Nucor shut down its DRI plant, as the pricing environment did not favor using iron ore as a raw material. However, there’s another angle to higher iron ore prices that we’ll explore in the next part of the series.

Investors who want to avoid the hassles of picking individual stocks can also consider the SPDR S&P Metals and Mining ETF (XME). Currently, XME has invested more than half of its holdings in US-based steel companies. Commercial Metals Company (CMC) and Timken Steel (TMST) form ~6.7% of XME’s portfolio.