Opportunities and Challenges for Samsung in the Smartphone Market

The slowdown in smartphone sales has impacted the revenues of both Samsung and Apple. Both expect a significant slowdown in smartphone sales in fiscal 2016.

March 15 2016, Updated 2:06 p.m. ET

Samsung and Apple post weak guidance for smartphone sales

The slowdown in smartphone sales has impacted the revenues of both Samsung (SSNLF) and Apple (AAPL). Both companies expect a significant slowdown in smartphone sales in fiscal 2016.

Let’s understand the challenges and opportunities available in the smartphone market and how Samsung is looking to capitalize on them.

Challenges in the smartphone space

Revenue and operating profit from Samsung’s mobile segment fell 7% quarter-over-quarter in fiscal 4Q15. The fourth quarter was filled with challenges for the mobile business:

- The strengthening Korean won made Samsung’s products expensive.

- Competition intensified from Chinese handset makers, who are offering similar technology at lower prices.

- Samsung’s high-end flagship product Galaxy S6 failed to earn the desired revenue, forcing the company to cut the price of the device within just three months of its launch date.

- The overall smartphone industry reported a slowdown in sales in 4Q15.

Changing smartphone market trend

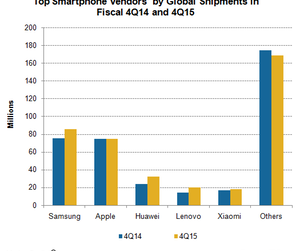

According to the IDC (International Data Corporation), worldwide smartphone shipments rose 5.7% YoY (year-over-year) in 4Q15, with Apple reporting the slowest growth of 0.4% and Samsung reporting reasonable growth of 14% YoY.

While the two behemoths continued to report slow and moderate growth, China’s (MCHI) Huawei and Lenovo emerged as strong players, reporting significant growth of 37% YoY and 43.6% YoY, respectively, in 4Q15.

Leading mobile chipmaker Qualcomm (QCOM) and Samsung noted that the trend is moving away from high-end smartphones toward mid- and low-end smartphones. Capitalizing on this trend, Qualcomm signed licensing agreements with five top Chinese handset makers including Huawei and Lenovo.

Samsung’s strategy to push revenue growth

Despite the challenging environment, Samsung is looking to maintain a double-digit margin in the mobile business by streamlining its smartphone product portfolio, capitalizing on mid- and low-end smartphone demand, and improving competitiveness by offering software, hardware, services, and wearable products along with its smartphones.

Samsung is also launching its flagship product Galaxy S7 in order to boost sales. If this product proves to be a success, it will also benefit suppliers Qualcomm, Cirrus Logic (CRUS), and STMicroelectronics (STM).