What Enabled Adobe to Raise Its Digital Media ARR?

The continued migration of Creative Suite and the addition of new Creative Cloud subscriptions contributed towards Adobe’s subscription growth.

Sept. 1 2020, Updated 11:01 a.m. ET

Creative Cloud subscriptions boosted Adobe’s performance in 1Q16

Previously in the series, we discussed how Adobe’s recently announced (ADBE) fiscal 1Q16 results continued to surpass analysts’ expectations. Fiscal 1Q16 marked the tenth consecutive quarter that Adobe’s earnings topped Market expectations.

The continued migration of Creative Suite, a subsegment of Adobe’s Digital Media segment, and the addition of new Creative Cloud subscriptions during the quarter contributed towards Adobe’s subscription growth. Adobe’s subscription includes software, selected services for file sharing and publishing, and access to Apple (AAPL) iOS and Google (GOOG) (GOOGL) Android apps.

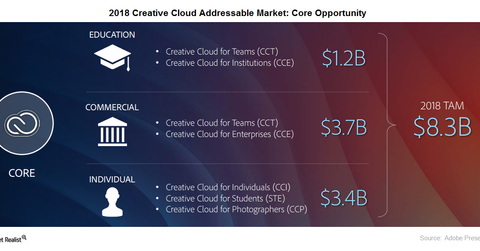

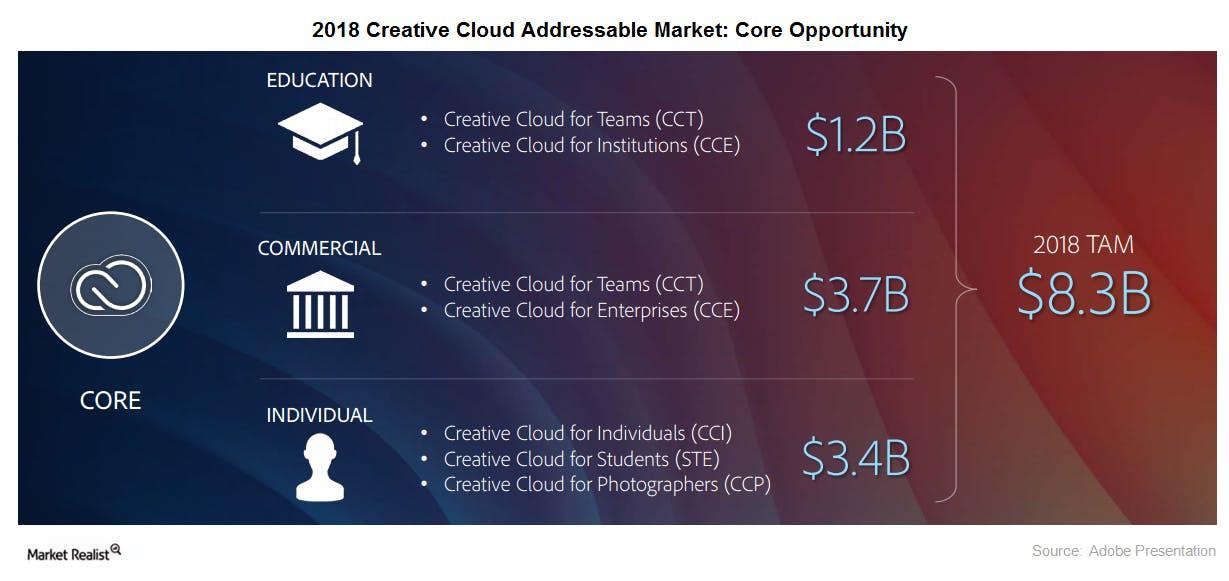

As the above presentation shows, Creative Cloud is expected to become an $8.3 billion market. It will account for more than one-third of the $21 billion digital media market by 2018. Creative Cloud’s continued growth momentum in the Digital Media segment played a key role in Adobe’s overall growth.

As the above presentation shows, Creative Cloud is expected to become an $8.3 billion market. It will account for more than one-third of the $21 billion digital media market by 2018. Creative Cloud’s continued growth momentum in the Digital Media segment played a key role in Adobe’s overall growth.

Creative Cloud’s revenue grew 44% on a YoY (year-over-year) basis to reach $733 million. It caused the Digital Media segment’s revenue to grow 33% in 1Q16. Adobe raised its Digital Media ARR (annual reoccurring revenue) guidance to $4.0 billion for fiscal 2016 from the earlier provided guidance of $3.88 billion.

Approximately 798,000 new Creative Cloud subscribers were added across individual, team, and enterprise accounts in 1Q16. This made the total number of subscribers rise to 4.25 million. Adobe’s Creative Cloud is hosted on Amazon (AMZN) Web Services.

Adobe won’t provide quarterly subscription figures

Fiscal 1Q16 was the last quarter that Adobe provided quarterly updates on Creative Cloud subscriber growth. Adobe won’t be providing quarterly Creative Cloud subscription figures. Adobe accounts for 0.24% of the iShares Core S&P 500 ETF (IVV). For investors interested in exposure to application software, IVV has an exposure of 8.5% to the sector.