Why Is AT&T Offering DirecTV as an Over-the-Top Service?

AT&T is planning to enter the IP-based video delivery market by offering DirecTV as an OTT (over-the-top) service in the fourth quarter of 2016.

Dec. 4 2020, Updated 10:52 a.m. ET

AT&T’s plans to offer DirecTV over the Internet

AT&T (T) is also planning to enter the IP-based video delivery market. Early in March, The Wall Street Journal reported that the company has stated that it is planning to offer DirecTV as an OTT (over-the-top) service in the fourth quarter of 2016. The company “also plans to sell a version of the service for mobile devices and a separate, free ad-supported streaming service.”

The company did not disclose the pricing of this service or the kind of content that it plans to offer. Other telecommunications companies that are already offering video streaming services for mobile devices include Verizon Communications’ (VZ) go90 and T-Mobile’s (TMUS) Binge On service. DISH Network (DISH) has a pay-TV service with an OTT option, Sling TV, priced at $20 per month.

Why is AT&T going over the top?

Earlier this month, John J. Stephens, AT&T’s CFO (chief financial officer) and Executive Vice President, discussed the company’s new offerings, which will target non-pay-TV households in the US, at the Deutsche Bank Media, Internet, and Telecom Conference.

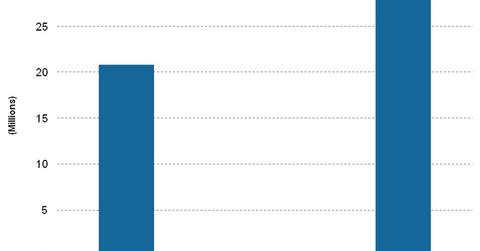

Stephens stated that there are “about 20 million homes that are unattached that don’t have a video service today,” positing that “if we can come up with some of our new DTV Now or DTV Mobile, of DTV Preview type products and get an opportunity to penetrate those, we can…have revenue opportunities at still significant levels, as well as a really good partnership with our content providers.”

Stephens also mentioned that “those revenues opportunities are not only on the service revenue side, but also on advertising and so forth,” which “gets us optimistic.”

Expanding market in the US

The market that AT&T is targeting with DirecTV Now, DirecTV Mobile, and DirecTV Preview is expected to expand in the medium term in the US. According to a report by eMarketer, non-pay-TV households in the US are expected to increase from ~20.8 million in 2015 to ~28.1 million in 2019. Notably, AT&T makes up about 1.3% of the SPDR S&P 500 ETF (SPY), which has an exposure of 3.8% to computers.