How Has Honeywell Stock Performed since 3Q17 Earnings?

Since Honeywell (HON) declared its 3Q17 earnings on October 20, 2017, HON stock has risen ~9.0% as of January 22, 2018.

Jan. 23 2018, Published 8:46 a.m. ET

Honeywell to report 4Q17 earnings

Honeywell (HON) is set to announce its 4Q17 earnings on January 26, 2018, during market hours. It will hold a conference call on the same day at 8:00 AM EST. In this series, we’ll be looking at Honeywell’s stock performance since its 3Q17 earnings. We’ll also look at analysts’ revenue and EPS (earnings per share) estimates and the latest recommendations for the stock. Plus, we’ll compare HON’s latest valuation against its peers and look at HON’s short interest.

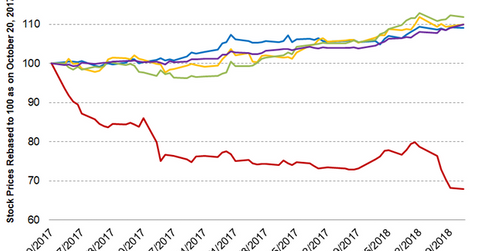

Since HON declared its 3Q17 earnings on October 20, 2017, HON stock has risen ~9.0% as of January 22, 2018. However, despite good gains, it underperformed the broad-based SPDR S&P 500 ETF (SPY), which gained 9.9%. HON also underperformed peers United Technologies (UTX) and Textron (TXT), which have gained 11.8% and 10.0%, respectively. HON managed to outperform General Electric (GE), which fell 32.2% during the same period.

HON’s stock performance was primarily driven by the continued new business deal in its aerospace and UOP business. During 4Q17, HON’s UOP business signed five new contracts. All these factors have pushed HON stock prices up. Further, the positive EPS guidance for 2018 of $7.55 to $7.80 also helped the stock.

Moving averages and RSI

The strong gains in HON’s stock prices have resulted in the stock trading 7.6% above the 100-day moving average price of $147.38. HON’s 14-day relative strength index of 65 indicates that the stock is neither overbought nor oversold. An RSI of 30 and below indicates that the stock has moved temporarily into an oversold position, while an RSI of 70 and above indicates that the stock has moved into the overbought position temporarily.