What’s Driving Palo Alto Networks’ Customer Base?

Palo Alto Networks (PANW) has maintained strong growth in customer additions, driven by its product portfolio and service quality.

April 24 2018, Updated 3:37 a.m. ET

Identifying the key catalysts

Palo Alto Networks (PANW) has maintained strong growth in customer additions, driven by its product portfolio and service quality. The ongoing digital transition across enterprises and growing cybersecurity threats have also continued to act as strong catalysts for the company’s customer growth.

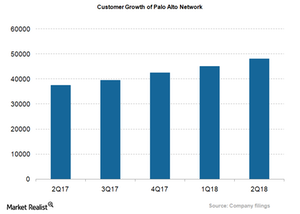

In addition, strategic partnerships with large cloud providers such as Amazon’s (AMZN) AWS (Amazon Web Services) and Microsoft’s (MSFT) Azure have made Palo Alto’s products easily accessible to clients, driving customer growth. In the last five quarters, Palo Alto Networks has added 12,500 new customers, at an average of ~2,500 clients per quarter.

Customer growth and purchase size

The graph above shows Palo Alto Networks’ customer base growth in the last five quarters. In fiscal 2Q18, the company added ~3,000 new customers. It exited fiscal 2Q18 with more than 48,000 customers, compared with 37,500 in fiscal 2Q17. In fiscal 1H18, Palo added 5,500 customers, compared with 6,500 in 1H17.

In 2Q18, Palo Alto’s top 25 clients made minimum purchases of ~$25.6 million, compared with $16.6 million in fiscal 2Q17. Therefore, customers’ increased spending on security products may boost the company’s top line. Threat prevention, URL (Universal Resource Locator) filtering, and WildFire software, the company’s top three products, were used by 42,000, 35,000, and 23,000 customers, respectively.