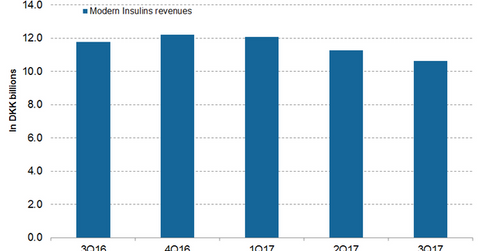

How Did Novo Nordisk’s Modern Insulin Segment Perform in 3Q17?

In 3Q17, Novo Nordisk’s (NVO) NovoRapid reported revenues of 5.0 billion Danish krone (or DKK), which reflected ~9% growth on year-over-year (or YoY) basis.

Jan. 5 2018, Updated 7:37 a.m. ET

NovoRapid revenue trends

In 3Q17, Novo Nordisk’s (NVO) NovoRapid reported revenues of 5.0 billion Danish krone (or DKK), which reflected ~9% growth on year-over-year (or YoY) basis. In 3Q17, in the US, Europe, AAMEO (Asia, Africa, Middle East and Oceania), China, Japan & Korea, and Latin America, NovoRapid generated revenues of 2.7 million DKK, 1.1 million DKK, 559 million DKK, 307 million DKK, 227 million DKK, and 84 million DKK, respectively. In 3Q17, in the US, AAMEO, Europe, China, and Latin America, NovoRapid witnessed ~8%, 2%, 20%, 22%, and 58% growth on a YoY basis, respectively. Sales in Japan and Korea remained flat.

NovoRapid reported revenues for the first nine months of 2017 (or 9M17) of 15.4 billion DKK, which is ~8% growth on YoY basis. In the U.S., Europe, AAMEO, China, Japan & Korea and Latin America, NovoRapid generated 9M17 revenues of DKK 8.4 billion, DKK 3.2 billion, DKK 1.7 billion, DKK 952 million, DKK 699 million, and DKK 246 million, respectively.

Levemir revenue trends

In 3Q17, Novo Nordisk’s Levemir reported revenues of DKK 3.16 billion which reflected ~23% decline YoY basis.

In 3Q17, in the U.S., Europe, AAMEO, China, Japan & Korea and Latin America, Levemir generated revenues of DKK 2.0 billion, DKK 567 million, DKK 224 million, DKK 175 million, DKK 30 million and DKK 89 million, respectively. In 3Q17, in the U.S., AAMEO, Europe China, Japan& Korea and Latin America, Levemir witnessed ~32% decline, 12% decline, 9% growth, 26% growth, 19% decline and 52% growth on YoY basis.

Levemir reported 9M17 revenues of DKK 10.7 billion which is ~17% decline on YoY basis.

In the U.S., Europe, AAMEO, China, Japan & Korea and Latin America, Levemir generated 9M17 revenues of DKK 7.18 billion, DKK 1.8 billion, DKK 687 million, DKK 525 million, DKK 101 million, and DKK 257 million, respectively.

In 3Q17, Novo Nordisk’s peers in insulin market Eli Lilly (LLY), Sanofi (SNY) and MannKind Corporation (MNKD) reported revenues of $5.7 billion, $10.6 billion, and $2.0 million, respectively. Notably, Vanguard FTSE All-World ex-US ETF (VEU) invests ~0.37% of its total portfolio holding in Novo Nordisk.

In the next article, we will discuss the performance of Novo Nordisk’s Modern insulin NovoMix and human insulin.