Looking Ahead: Kroger Continues Its Aggressive Acquisition Strategy

Taking The Fresh Market (TFM) under its fold would enhance Kroger’s (KR) expansion in Florida and North Carolina, where TFM has 40 and 20 stores, respectively.

Feb. 16 2016, Updated 12:05 p.m. ET

The Kroger Company’s recent mergers and acquisitions

The Kroger Company (KR) has been quite active in expanding through the inorganic route and has completed a couple of important acquisitions in recent years. In November 2015, Kroger acquired Roundy’s, a chain of 151 stores and 101 pharmacies, for $800 million. In January 2014, the company acquired Harris Teeter, a regional chain of more than 200 stores. With Harris Teeter, Kroger expanded its presence in the Southeastern and mid-Atlantic markets. Both Harris Teeter and Roundy’s continue to operate under their respective store banners. In August 2014, Kroger also acquired Vistacost.com, a leading online retailer in the nutrition and healthy living market, to accelerate its growth in the online space.

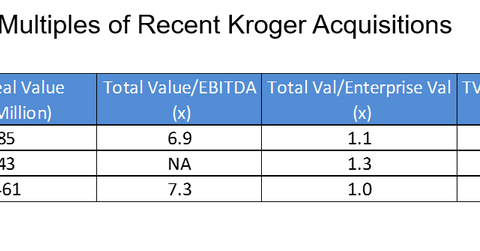

Recent deal multiples

To give you a snapshot of Kroger’s recent deals, we’ve provided the deal multiples of its Kroger’s acquisitions in the chart above. The total deal value to enterprise value multiple of Kroger’s last three deals has been between 1.0x and 1.3x. While Kroger bought Roundy’s at a cheap EV-to-EBITDA (enterprise value to earnings before interest, tax, depreciation, and amortization) multiple of 1.6x, it purchased Harris Teeter at an EV-to-EBITDA multiple of 7.3x.

What will The Fresh Market give to Kroger?

The Fresh Market (TFM) has 180 stores across 27 states. The company follows a small-box format with an average store size of 21,000 square feet. Kroger, on the other hand, is a much bigger chain with more than 2,600 supermarkets across the United States. It also has considerably bigger stores. The company’s combination stores are typically 76,000 square feet in size, while it’s Fred Meyer stores have an average size of 161,000 square feet. TFM, however, has better store profitability. It recorded a gross profit per square foot of $175 in fiscal 2015 as compared to Kroger’s $142 per square foot.

TFM is mainly present in the eastern part of the United States. Taking TFM under its fold would further enhance Kroger’s footprint in the eastern US organic and natural food markets. The acquisition would specifically enhance Kroger’s expansion in Florida and North Carolina, where TFM has 40 and 20 stores, respectively. On the other hand, this deal would make TFM stronger to fight against Sprouts Farmers Market (SFM) and Trader Joe’s, which are increasingly expanding eastward into TFM’s territories.

Kroger has a market cap of ~$37 billion (as of February 12, 2015) and is a component of the S&P 500 Index and the S&P 500 Food & Staples Retail Index. It is the largest US supermarket operator and one of the world’s largest grocery retailers, surpassed only by Walmart (WMT) in grocery sales. The company has weights of ~1% in the SPDR S&P Retail ETF (XRT), ~0.2% in the SPDR S&P 500 ETF (SPY), and ~2.3% in the SPDR Consumer Staples Select Sector Fund (XLP).