TJX Companies’ US Business in Fiscal 4Q16

The US business of TJX Companies consists of 1,156 T.J. Maxx stores, 1,007 Marshalls stores, 526 HomeGoods stores, and eight Sierra Trading Post stores.

Feb. 29 2016, Updated 10:08 a.m. ET

Performance of US business

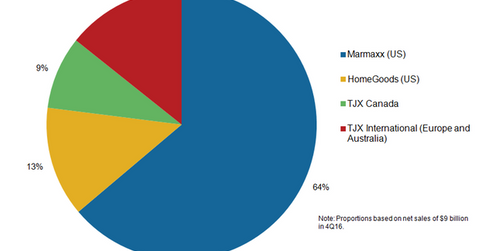

The US business of TJX Companies (TJX) consists of 1,156 T.J. Maxx stores, 1,007 Marshalls stores, 526 HomeGoods stores, and eight Sierra Trading Post stores. The company also operates two e-commerce websites tjmaxx.com and sierratradingpost.com in the US, and the company’s Marmaxx division, which includes T.J. Maxx, Marshalls, and tjmaxx.com, is its largest division in terms of sales.

Strong performance by Marmaxx

In 4Q16, sales of Marmaxx increased by 8.2% to $5.7 billion. The same-store sales of Marmaxx increased by 6% in 4Q16—twice the same-store sales growth of 3% in 4Q15. Strong consumer traffic was the primary sales growth driver. In the company’s 4Q16 conference call, Scott Goldenberg, TJX’s Chief Financial Officer stated that the company’s merchandising and value strategies resulted in a significant increase in the transactions and units sold in the Marmaxx division. However, the quarter saw a decrease in the average ticket.

The segment profit of Marmaxx increased by 8.6% in 4Q16. The segment profit margin was flat in 4Q16 as higher merchant margin, buying, and occupancy leverage on higher same-store sales were offset by higher wages, increased supply chain cost, and investments in e-commerce.

Nordstrom, Ross Stores, and Burlington Stores

Off-price Nordstrom Rack stores, which are operated by Nordstrom (JWN), reported sales growth of 6.9% in the comparable fourth quarter, mainly due to new stores. Same-store sales of Nordstrom Rack stores declined by 3% in the fourth quarter.

The pure-play, off-price competitors of TJX Companies in the US include Ross Stores (ROST) and Burlington Stores (BURL). These two companies are announcing their fourth quarter results on March 1 and March 3, respectively. Ross Stores and Burlington Stores reported same-store sales growth of 3% and 2.8%, respectively, in the third quarter, which ends October 31, 2015.

HomeGoods in 4Q16

Sales of TJX’s HomeGoods division increased by 14.2% to $1.2 billion in 4Q16. The same-store sales of the division increased by 7% in 4Q16 compared to an 11% growth in 4Q15. The segment’s profits increased by 19%, and segment’s profit margin increased by 60 basis points, driven by a strong increase in merchandise margins.

Store growth potential

In fiscal 2017, ending January 28, 2017, the company plans to add a total of 195 stores, bringing the total store count to 3,809 stores. In the US, the company plans to open about 60 Marmaxx stores and 50 HomeGoods stores. The company also plans to open about five additional Sierra Trading Post stores in fiscal 2017.

In the long-term, the company sees the potential to grow Marmaxx to ~3,000 stores. The company believes that its HomeGoods stores can touch at least 1,000 stores—almost double its existing base. Notably, the PowerShares Dynamic Large Cap Growth ETF (PWB) has 1.6% exposure to TJX Companies.

We’ll discuss the performance of the company’s international business in the next part of this series.