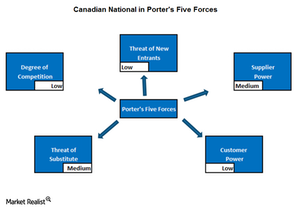

Assessing Canadian National through Porter’s Five Forces

In this part, we’ll do a Porter’s Five Forces check for Canadian National (CNI). The threat of new entrants is relatively low for CNI. The railroad industry is extensively capital intensive, with maintenance capital spending accounting for the highest share.

Feb. 25 2016, Updated 12:12 p.m. ET

Porter’s Five Forces

In this part, we’ll do a Porter’s Five Forces check for Canadian National (CNI). With the exception of Genesee and Wyoming (GWR), all the companies we discuss in this article form part of the US Class I railroads. The Morningstar Wide Moat ETF (MOAT) invests 15.64% in railroads.

First force: Threat of new entrants

The threat of new entrants is relatively low for CNI. The railroad industry is extensively capital intensive, with maintenance capital spending accounting for the highest share. In the current scenario, expansion through heavy investment in new tracks is not a good idea. Competitors’ entry is restricted due to right-to-operate tracks, manpower training, and the cost of railcars.

Second force: Degree of competition

Service reliability, service quality, and time sensitivity are the main parameters for competition with other railroads and other modes of transportation. In some cases, specialized equipment or its quality can act as a dimension for competition. The company’s sole access to the Port of Prince Rupert in British Columbia gives some leverage compared with Canadian Pacific (CP), which is CNI’s main competitor railroad.

In the Northeast US, it faces some competition from Norfolk Southern (NSC). East of the Mississippi River, it also faces competition from CSX Corporation (CSX). Although these Class I railroads compete with each other, they are also each other’s customers. This is due to the interchange of merchandise with other railroads.

Third force: Threat of substitution

Canadian National’s intermodal business competes with trucking. In the low fuel price era, long-distance transportation through freight rails is usually advantageous. Trains are nearly four times more fuel efficient than trucks.

Currently, CNI is facing strong competition from trucking companies in the current low energy price environment. Apart from this, the company also competes with barge lines and other maritime shipping for certain commodities. Hence, the threat of substitution is usually dependent on fuel prices.

Fourth force: Customer power

For Canadian National, the customers’ bargaining power is low in Canada. However, on some specific routes in the eastern US, customers have the option between NSC, CSX, and CNI. CNI’s Canadian customers have slightly high switching costs compared with a section of customers based in the eastern US.

Genesee and Wyoming (GWR) operates short lines over roughly 75% of the US, and it is often compared with other Class I railroads. It faces stiff competition from other short line operators, which is usually not the case with Class I railroads.

All of the above-mentioned companies except GWR, CP, and CNI are part of railroad stocks held by the Industrial Select Sector SPDR ETF (XLI). This ETF holds 7.98% in the sector.

Fifth force: Supplier power

Canadian National is dependent on locomotive manufacturers like EMD and GE Transportation. GE is one of world’s biggest locomotive suppliers. Due to its capital-intensive nature, the new manufacturers face high entry barriers. Similarly, roughly 75% of CNI’s employees are unionized. Overall, the suppliers have a medium level of power.

In the next part, we will take a look at the Intermodal Markets business of Canadian National.