Analyst Ratings for Thermo Fisher Scientific before 4Q17 Results

Thermo Fisher Scientific (TMO) will announce its 4Q17 and fiscal 2017 results on January 31, 2018. It has launched some innovative products and entered into strategic collaborations and partnerships.

Jan. 25 2018, Published 11:37 a.m. ET

Analyst recommendations

Thermo Fisher Scientific (TMO) will announce its 4Q17 and fiscal 2017 earnings results on January 31, 2018. The company has launched a number of innovative products and entered into strategic collaborations and partnerships throughout the quarter. Let’s take a look at its latest analyst recommendations and target prices.

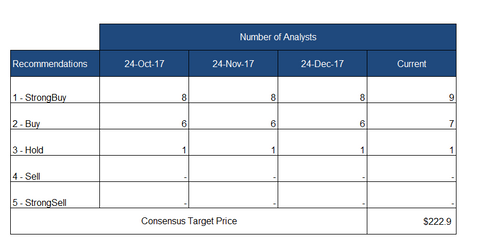

As of January 24, 2018, according to a recent Reuters survey of 17 brokerage firms, 16 analysts have a “buy” or “strong buy” rating for TMO stock. One analyst rated the stock a “hold.” There were no “sell” ratings. For an overview of recommendations, see the above table.

Target prices

As of January 24, 2018, according to the analysts included in the recent Reuters survey, the consensus 12-month target price for TMO stock is $222.94, which implies a potential investment return of 3.9% over the next 12 months. The return potential is based on the stock’s closing price of $214.55 on January 23, 2018.

Wall Street analysts’ consensus target prices for TMO’s peers Abbott Laboratories (ABT), Boston Scientific (BSX), and Becton Dickinson (BDX) are $63.72, $31.09, and $236.31, respectively. These prices represent potential investment returns of 7.6%, 11.7%, and 0.68%, respectively, over the next 12 months.

Rating revisions and updates

On January 19, 2018, Deutsche Bank raised its target price on TMO stock from $226 to $241. On January 4, 2018, Barclays increased its price target on TMO stock from $215 to $225 and maintained an “overweight” rating on the stock. The target price was raised following a positive 2018 outlook update on the life science tools and diagnostics industry. On the day of the update, TMO stock rose ~1.2%, and the Vanguard Growth ETF (VUG) rose ~0.27%. VUG has 0.75% of its total portfolio in TMO.

On January 3, 2018, Evercore ISI assumed coverage of TMO stock with an “outperform” rating and a target price of $222 per share. On January 5, 2018, BTIG Research initiated coverage of TMO stock with a “buy” rating and a target price of $230.