How Is Nvidia’s Capital Structure Compared to Its Rivals’?

Nvidia’s free cash flow to net income ratio indicates that it has a strong capital structure to withstand headwinds and bear significant capital expenditure.

Jan. 20 2016, Updated 9:05 a.m. ET

Nvidia’s capital structure

So far, we’ve looked at the potential growth opportunities changing computing trends are bringing for Nvidia (NVDA) as well as the potential risks Nvidia faces. Combining these two factors, let’s take a look at Nvidia’s capital structure and the risks and benefits this structure brings to investors.

Expenses

Nvidia adopts a fabless model just like its rival Advanced Micro Devices (AMD). In a fabless model, a company spends a huge amount on R&D (research and development) and outsources manufacturing to third-party foundries.

In a typical scenario, a semiconductor company invests more in R&D when revenues are slow. On top of this, there is an SG&A (selling, general, and administrative) expense, which is almost the same every year.

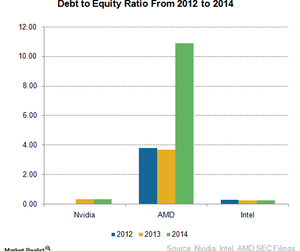

Debt to equity ratio

In the past few articles, we’ve seen that semiconductor companies’ revenues are volatile in nature. Given this uncertain revenue environment, equity is the ideal capital structure of a semiconductor company. As seen in the above graph, Intel (INTC) and Nvidia’s debt-to-equity ratios are in the range of 0.22–0.32. AMD has a debt that is more than ten times its equity. In 2012, Nvidia had no debt.

Qualcomm’s (QCOM) debt-to-equity ratio was 0.32 in 2015, equivalent to Nvidia’s. Qualcomm had no debt until 2014 given the volatile nature of its business.

Cash position

Looking at its cash position, Nvidia has significant free cash available for its shareholders. Its free cash flow to net income ratio stood at 1.24 in 2014, higher than AMD’s 0.48, Intel’s 0.87, and Qualcomm’s 0.86. This indicates that Nvidia has a strong capital structure to withstand headwinds and bear significant capital expenditure.

The iShares Core S&P 500 ETF (IVV) has exposure to large-capitalization funds, including a 0.09% exposure to Nvidia.