A Look at Walgreens Boots Alliance’s Retail Pharmacy USA Division

The Retail Pharmacy USA division is Walgreens Boots Alliance’s (WBA) largest revenue generator.

Jan. 20 2016, Updated 2:42 p.m. ET

Overview of the Retail Pharmacy USA segment

The Retail Pharmacy USA division is Walgreens Boots Alliance’s (WBA) largest revenue generator. Under this segment, the company operates pharmacy-led health and beauty retail businesses in the United States. As of August 31, 2015, WBA had a presence in 50 US states, the District of Columbia, Puerto Rico, and the US Virgin Islands. Duane Reade and Walgreens are the company’s principal retail pharmacy brands in this division. The synergies and benefits arising from Walgreens Boots’ proposed acquisition of Rite Aid (RAD) will be entirely within this division.

Financial summary

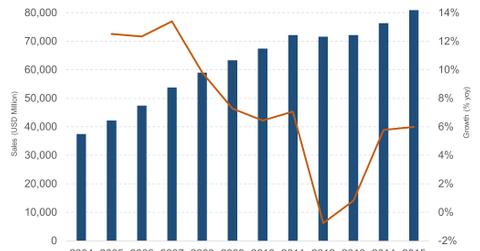

The Retail Pharmacy USA division generated sales of ~$82 billion in fiscal 2015, a year-over-year increase of 6%. Sales on a comparable store basis increased by 6.4%. The segment’s operating margin at 4.8% was the highest among all Walgreens Boots’ segments.

Agreement with AmerisourceBergen

In March 2013, Walgreens and AmerisourceBergen (ABC) entered into a ten-year pharmaceutical distribution agreement, under which Walgreens would source branded and generic pharmaceutical products from AmerisourceBergen in the United States. According to the agreement, Walgreens also has the right, but not the obligation, to purchase a minority equity position in AmerisourceBergen and gain representation on AmerisourceBergen’s board of directors. As of August 31, 2015, Walgreens Boots owned ~5.2% of AmerisourceBergen’s shares and had designated one member of AmerisourceBergen’s board of directors.

The top four of the US drugstore industry

Through its Retail Pharmacy USA division, Walgreens Boots Alliance operates the highest number of pharmacies in the United States, with 8,173 as of August 31, 2015. It is closely followed by CVS Health (CVS), which operates a little less than 8,000 pharmacies. Walgreens Boots Alliance’s acquisition target, Rite Aid (Rite Aid), has more than 4,500 pharmacy stores, and Walmart has close to 4,000 stores in the United States.