JCPenney Stock Still in the Red, Analysts Mostly Say ‘Hold’

Nine out of 25 analysts have a “buy” recommendation for JCPenney’s (JCP) stock, ten have a “hold” recommendation, and six gave a “sell” recommendation.

Nov. 20 2020, Updated 2:25 p.m. ET

Analysts’ recommendations

As of January 26, nine out of 25 analysts have a “buy” recommendation for JCPenney’s (JCP) stock, ten have a “hold” recommendation, and six gave a “sell” recommendation. JCPenney’s sales have improved in the first nine months of fiscal 2015. However, the company’s bottom line is still in the red.

Upside potential

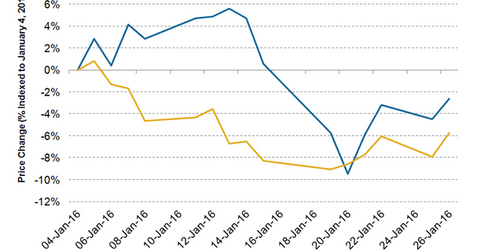

As of January 26, JCPenney’s stock was trading at $6.79. The consensus analysts’ 12-month price target for JCPenney is $9.76, reflecting upside potential of 43.7%. So far, JCPenney’s stock has fallen 2.6% compared to a 5.4% decline in the S&P 500 Index.

The SPDR S&P Retail ETF (XRT), which has 1.1% exposure to JCPenney, has fallen 5.7% since the beginning of 2016. Nordstrom (JWN) and Kohl’s (KSS) have fallen 4.2% and 1.9%, respectively, on a year-to-date basis. As of January 26, Macy’s (M) stock price has appreciated by 12.3% since the start of the year. Macy’s stock price in January benefitted from the announcement of the company’s restructuring plan and news of a stake purchase by David Einhorn’s Greenlight Capital.

Analysts expect JCPenney to report an adjusted loss per share of $1.21 in fiscal 2015, which ends January 30, 2016. This loss compares to a loss per share of $2.67 in the previous fiscal year. The company reaffirmed its full-year adjusted EBITDA[1. Earnings before interest, tax, depreciation and amortization] target of $645 million for fiscal 2015 following strong holiday results on January 7. The company also aims to generate a positive free cash flow in fiscal 2015.

Growth initiatives

JCPenney’s sales are benefiting from the company’s growth initiatives, including a focus on higher-margin private brands, expansion of the Sephora beauty business, and enhancing omnichannel capabilities. On January 19, JCPenney announced its decision to bring back appliances into its stores after more than three decades. All these initiatives are expected to boost the company’s sales and benefit the bottom line. Currently, analysts expect JCPenney to post a profit in fiscal 2017.

For more updates, visit our Department Stores page.