Cliffs Natural Resources: 4Q15 Market Expectations

Of 15 analysts covering Cliffs Natural Resources, eight have given it a “hold” recommendation, and seven have given it a “sell” recommendation.

Jan. 22 2016, Updated 6:06 a.m. ET

Analysts’ recommendations

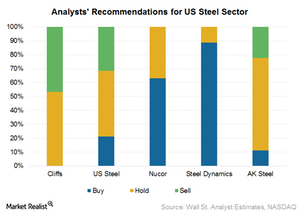

The market has become more bearish on Cliffs Natural Resources (CLF). Of 15 analysts covering the company, eight have given it a “hold” recommendation, and seven have given it a “sell” recommendation. The stock has received no “buy” recommendations. The average target price for CLF is $1.8.

In comparison, Nucor Corporation (NUE) and Steel Dynamics (STLD) have received 63% and 89% “buy” recommendations, respectively, but no “sell” recommendations. United States Steel Corporation (X) and AK Steel Holding Corporation (AKS) have received 21% and 11% “buy” recommendations and 32% and 22% “sell” recommendations, respectively.

Investors can also consider the Materials Select Sector SPDR Fund (XLB) to get diversified exposure to the materials sector. Nucor forms 2.8% of XLB’s portfolio.

Expectations for 4Q15

Wall Street analysts estimate that Cliffs Natural Resources’ (CLF) sales will come in at $504 million for 4Q15. The estimate for adjusted EBITDA (earnings before interest, tax, depreciation, and amortization) for 4Q15 is $47.3 million.

Wall Street analysts’ EPS (earnings per share) estimate for CLF in 4Q15 is a loss of $0.26 per share. Cliffs Natural Resources has beaten estimates in five out of its last eight earnings releases. Cliffs Natural Resources’ share price has reacted positively to the news of the company beating estimates.

Series of downgrades since 3Q15

The only remaining “buy” recommendation for Cliffs Natural Resources’ stock was also downgraded. Macquarie Group downgraded CLF from a “buy” to a “hold” on January 8. It also reduced CLF’s target price from $6 to $1.6. Macquarie Group’s argument for the downgrade is as follows: “Shutting projects, curtailing production, focusing on the United States and paying down debt … have likely saved the company. Unfortunately, the domestic steel market remains weak, driven by lacklustre demand.”

On December 17, 2015, Deutsche Bank also downgraded Cliffs from a “hold” to a “sell.” It also reduced the target price by half from $3. Jorge Beristain, a Deutsche Bank analyst, cited Cliffs Natural Resources’ “strained Balance Sheet position and a scenario of constrained cash flows given ongoing weakness in iron ore market.”

FBR & Co. also slashed CLF’s target price from $3 to $1 in December 2015.

In the next part of this series, we’ll discuss analysts’ estimates for Cliffs Natural Resources in more detail.