How Lowe’s Is Allocating Its Capital Expenditure Budget

Historically, a large percentage of Lowe’s (LOW) capital expenditure (or capex) has been spent on new store rollouts.

Nov. 22 2019, Updated 7:24 a.m. ET

Organic growth initiatives cause spike in capital expenditure

Historically, a large percentage of Lowe’s (LOW) capital expenditure (or capex) has been spent on new store rollouts. The company increased its store (XLY) count by 464 between fiscal 2007 and fiscal 3Q16. Store additions were boosted both by new stores and by Lowe’s acquisition of Orchard Supply Hardware in 2013, which we discussed in part nine. These smaller format and more niche stores added 72 outlets to the location count at the time of acquisition.

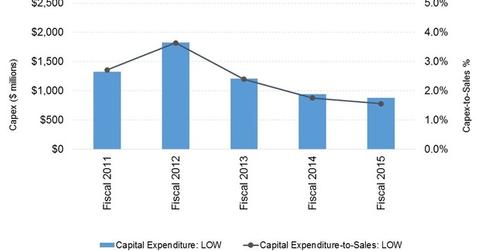

However, the pace of new store openings has eased somewhat since the Great Recession. In fiscal 2015, Lowe’s spent $0.9 billion on capex with eight new stores added.

Capex trends

In contrast, rival Home Depot (HD) rolled out 126 stores between fiscal 2007 to fiscal 3Q16. HD hasn’t opened a new store in the US in years. That’s part of the company’s stated goal to leverage the omnichannel opportunity and use its existing retail footprint to double as both brick-and-mortar stores and fulfilment centers. HD has been spending on digital investments, supply chain infrastructure, and customer-facing initiatives.

The capex-to-sales ratio in the most recent fiscal years for Lowe’s, Home Depot, Bed Bath & Beyond (BBBY), Restoration Hardware (RH), and Walmart (WMT) came in at 1.6%, 1.7%, 2.8%, 5.9%, and 2.5%, respectively.

Fiscal 2016 outlook

This year, Lowe’s plans to open 15-20 new stores, half of which would be leased. The company had opened nine stores in the first three quarters of the year. The company estimates its capital expenditure to come in at ~$1.3 billion in the current year, nearly 48% higher than the previous year. Here is a breakdown of the company’s capital expenditure budget:

- about 35% is earmarked for new stores

- ~40% of the capex is budgeted for existing stores including investments in product assortment, equipment, and technology

- ~20% of planned spending is earmarked for customer experience enhancements and other corporate initiatives

- Lowe’s expects to spend about 5% of its capex budget on enhancing its distribution networks

Implications

Both Home Depot and Lowe’s are applying a slightly different capital allocation strategy with respect to store additions. But it will be interesting to see whether Lowe’s can obtain the same or a higher return on invested capital and inventory turnover on its new smaller format stores.