Why George Soros Bought Amazon and Netflix

Legendary billionaire investor George Soros made some changes in his firm, Soros Fund Management LLC’s, portfolio in the first quarter.

May 17 2018, Published 12:45 p.m. ET

George Soros bought Amazon shares in 1Q18

Legendary billionaire investor George Soros made some changes in his firm, Soros Fund Management LLC’s, portfolio in the first quarter.

His firm bought nearly 51,200 shares of Amazon (AMZN) after selling his entire position in Amazon in 4Q17. The e-commerce giant has been a great player in the technology space (QQQ) over the past five years. On a year-to-date basis, the stock returned 33.5% as of May 16 and emerged as a best-performing stock.

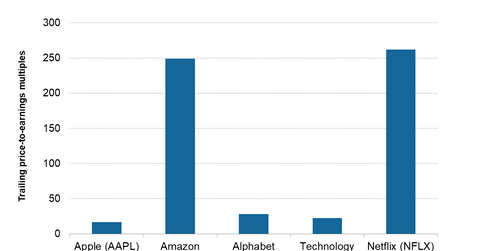

The Technology Select Sector SPDR ETF (XLK), which tracks the performance of the technology sector, rose 7.3% on a year-to-date basis. According to the institutional ownership report, Vanguard Group was the first largest investor in Amazon with 28.5 million shares in 1Q18. Amazon is trading with higher price-to-earnings multiples, largely supported by strong revenue growth.

Netflix

Similarly, billionaire investor George Soros again added 148,500 more Netflix (NFLX) shares to his firm’s portfolio in the first quarter after adding some shares in the fourth quarter of 2017. Netflix represented 1.06% of the firm’s portfolio in the first quarter, compared 0.31% in the fourth quarter.

Netflix has returned 63% so far in this year as of May 16. Although it’s trading at a higher price-to-earnings multiple than the industry, expectations for better earnings growth have mainly discounted this valuation. Soros’s strong position in this stock signals that it might have more room to grow.

In the next part of this series, we’ll analyze Soros’s top sells in the first quarter.