What Could Lead KKR’s Public Market Segment to Rise or Fall?

KKR has seen a decline in its base fees to $85.5 million in 1Q17 compared to $86.7 million in 4Q16.

May 19 2017, Updated 9:07 a.m. ET

Industry overview

The Federal Reserve has raised interest rates three times since the recession of 2007. In March 2017, the Fed raised rates by 25 basis points. This increase provided a clear outlook of another two or three rate hikes throughout 2017 depending on broad economic performance.

Rising interest rates have created some downward pressure on the pricing of credit market holdings. Alternative managers (XLF) like KKR (KKR) have seen subdued income performance in recent quarters and are expected to see a similar trend in the upcoming quarters due to rate hikes.

Public market and hedge fund

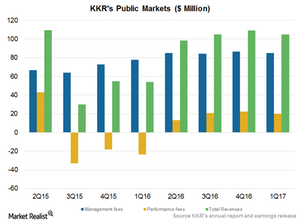

KKR has seen a decline in its base fees to $85.5 million in 1Q17 compared to $86.7 million in 4Q16. As far as KKR’s income performance is concerned, it has also shown a downward trend to $18.8 million compared to $22.5 million during the similar period. The fall was mainly due to lower realized incentive fees.

KKR’s funds in its Public Market segment were unable to perform due to a rate hike expectation, which was hinted at by a rate hike of 25 basis points in March 2017. KKR operates hedge funds and credit businesses through its Public Market segment. The company’s revenues in the Public Market segment are expected to increase solely through its hedge funds business in the current quarter.

With a view to becoming the world’s largest investor in the hedge funds category, KKR has finally decided to merge the company’s Prisma hedge fund business with PAAMCO (Pacific Alternative Asset Management Co.). In the new firm, 60% would be owned by its existing employees, and the remainder would be owned by KKR. KKR would manage an additional $34 billion.

The upcoming deal would give KKR an edge in the “hedge fund of funds” business, which is currently commanded by the Blackstone Group.

Assets under management

KKR’s decision of raising new capital has resulted in increased assets under management (or AUM) of $57.4 billion in 1Q17, compared to $55.7 billion in 4Q16, in the company’s Credit Market segment.

KKR’s major competitors include Blackstone Group (BX) and Apollo Global Management. Blackstone Group’s assets under management stand at $93.1 billion in the Credit Market segment. In 1Q17, its composite gross returns stood at 3.5% in performing credit and 2.8% in distressed credit.

Apollo Global Management (APO) has reported assets under management of $141 billion in its credit market segment. The company’s compelling economic income is backed by a rise in fair value of Athene Holding and higher carried interest income.

In 1Q17, Athene Holding’s fair value rose 5% when compared to 4Q16. APO is continually deploying capital in relation to structured credit, insurance-linked securities, opportunistic investments, and European real estate. In 1Q17, net credit returns stood at 1.6%, which was backed by improving performance across funds.

Apollo Global Management (APO), Carlyle Group (CG), and Blackstone Group (BX) together constitute 4.1% of the PowerShares Global Listed Private Equity ETF (PSP).