JAB to Challenge Nestle, Global Leader of Portioned Coffee Market

JAB’s share in the global coffee market is estimated to reach approximately 20% with the addition of Keurig’s brands and products to its portfolio.

Nov. 20 2020, Updated 1:29 p.m. ET

Packaged coffee industry

As we discussed in the first part of the series, JAB Holding, a privately held investment firm, will acquire Keurig Green Mountain (GMCR), primarily a packaged coffee and coffeemaker company.

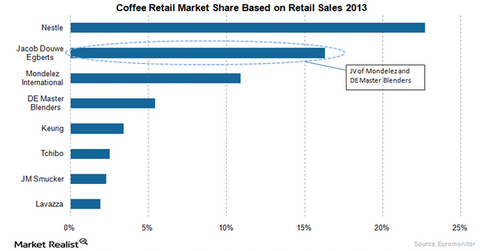

According to Euromonitor, the global packaged coffee market (XLP) is worth $80 billion and it is growing at an annual rate of 5%. Nestle (NSRGY) was the leader in the market with approximately 22.7% of the market share in 2013. According to Euromonitor estimates, Nestle held 28% of the global portioned coffee market.

With a market share of 16.3%, Jacob Douwe Egberts (JDE), the JV (joint venture) between Mondelez International (MDLZ) and DE Master Blenders, ranked second in the world’s coffee market. JAB has a controlling interest in JDE, which was formed in July 2015. In 2013, Keurig held the third position in the coffee market with a market share of 3.4%.

JAB to challenge Nestle, the global leader

The Keurig-JAB deal will bring together two main rivals of Nestle, Jacob Douwe Egberts in Europe and Keurig in North America. JAB’s share in the global coffee market is estimated to reach approximately 20% with the addition of Keurig’s brands and products to its portfolio.

According to Euromonitor, JAB’s share in the prepacked pods and capsules market is estimated to reach 41% once the Keurig deal is complete.

According to Euromonitor, Keurig held 61% of the North American single-serve coffee market compared to Nestle’s 4% share. However, Nestle’s main territory is Europe and it has been working to lift its popularity in the US.