DRAM Prices Fall Due to Weak Demand

DDR4 (double data rate 4) has been consistently gaining market share in overall DRAM (dynamic random access memory) production.

Dec. 22 2015, Published 7:55 p.m. ET

Strong adoption of DDR4

DDR4 (double data rate 4) has been consistently gaining market share in overall DRAM (dynamic random access memory) production, driven by the shift in demand as well as the maturation of 20nm (nanometer) technology. According to DRAMeXchange, DDR4 is set to replace DDR3 (double data rate 3) by the end of 4Q15. Also, upcoming PCs (personal computers) and notebooks manufactured by HP (HPQ), Microsoft (MSFT), Dell, Lenovo (LNVGF), and others will be equipped with Intel’s (INTC) Skylake processors and next-generation DRAM. DRAMeXchange expects DDR4 to become the dominant memory product, driven by mass shipments of Skylake-based PCs and notebooks, by the end of 2Q16.

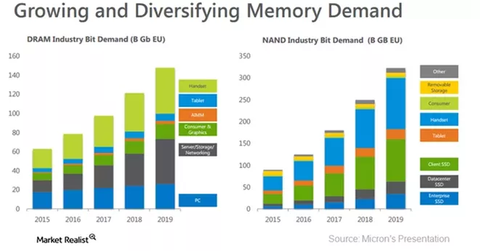

DRAM price decline expected to continue in 2016

In 2015, DRAM prices have fallen due to weak demand and excess supply, driven primarily by the fall in PC DRAM prices. According to DRAMeXchange, although production capacity has not increased significantly, DRAM suppliers are still profitable as the market is largely captured by three major players—Micron, Samsung and SK Hynix. Avril Wu, research director of DRAMeXchange, expects the annual demand and supply bit growth to be 23% and 25%, respectively, in 2016. As supply will outpace demand, analysts expect average sales prices to fall.

Intel comprises 19% of the VanEck Vectors Semiconductor ETF (SMH) and 9% of the iShares PHLX Semiconductor ETF (SOXX).