DowDuPont Will Spin Off into 3 Independent Public Companies

After the merger, DowDuPont will spin off into three independent and public companies—agriculture, material science, and specialty products.

Dec. 17 2015, Updated 2:05 p.m. ET

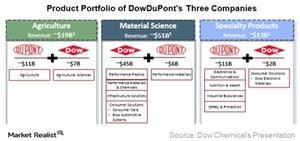

Product portfolio of three separate companies

Dow Chemical (DOW) and DuPont (DD) are the two leading chemical companies. They have diverse product portfolios in agricultural, performance materials, chemicals and plastics, and specialty products. After the merger, DowDuPont will be spinning off into three independent and public companies on the basis of its product portfolios. The three independent companies will be the agriculture, material science, and specialty products companies. Management’s strategy is to focus on each company with the different strategies to reduce the cost, improve the productivity, accelerate the growth, and achieve leadership positions across the businesses. Each company will have a separate advisory committee to guide and monitor the performance of each business.

Agriculture products

The agriculture chemical product-based company will include Dow Chemical’s agricultural science business and DuPont’s agricultural business. During the conference call, management talked about the product synergy in the agriculture business. For example, DuPont has the industry-leading germplasm and breeding products. Dow Chemical has a strong hold in traits and crop protection.

Now, DowDuPont will have the complete portfolio of germplasm and crop protection with almost a 50% contribution from each. Overall, the agriculture company will contribute around 22% to the combined company. The agriculture company will be the world’s largest chemical company in agriculture seeds and crop protection products. This company will have a 17% market share of the pesticides in the world. It will have 41% of the US corn seed market and 38% of the US soybean market. With research and development expertise and access to a large client base and geography, DowDuPont will have a competitive edge over major agricultural chemical players like Monsanto (MON) and Syngenta (SYT).

Material sciences products

The material sciences company will include Dow Chemical’s performance materials, performance plastic, infrastructure solution, and some of the consumer solution businesses. It will also include DuPont’s performance materials product segment. Management stated that ~70% of material science’s revenue is driven by three sectors—packaging, transportation, and construction.

Management also added that DowDuPont will have leadership positions in all three of the markets after the merger. The company will be the world’s largest packaging material supplier with a presence across packaging products and solutions. This would be the largest company with a revenue contribution of more than 50% to the combined company. This company will be the world’s second-largest company in the performance materials product segment. It will have a diversified product portfolio and access to a large customer base across regions. The company will significantly increase its margins and improve its productivity with the use of Dow Chemical’s low-cost feedstock platform. With improved productivity and better product portfolios, this material business would be in a better position to compete with the world’s largest company—BASF.

Specialty products

Part of Dow Chemical’s consumer solutions and DuPont’s industrial biosciences, electronics, nutrition and health, and safety and protection businesses will be part of the specialty products company. This company will contribute ~16% to the combined company. This business will be driven by extensive research and development activities, innovation, and technology development. Management focused on high-margin specialty products during the call. Management mentioned that DowDuPont will have the leadership position in high growth sectors like electronics, semiconductor materials, advanced packaging, solar photovoltaic materials, and display materials.

Overall, the separation into three companies is expected to have a positive impact on the company’s operational and financial performance if it successfully integrates and then spins off the combined companies into three companies.

The iShares U.S. Basic Materials ETF (IYM) primarily tracks the performance of the US-based basic material companies including chemical. Dow Chemical and DuPont account for 22% of IYM’s total holdings.