A Close Look at Adobe’s Margins in Fiscal 2015

A reduction in operating expenses, primarily sales and marketing (or S&M) and general and administrative (or G&A) expenses, led to an expansion in Adobe’s margins.

Dec. 4 2020, Updated 10:53 a.m. ET

Net income triple-digit growth signifies successful transition to cloud

Previously in the series, we discussed Adobe’s (ADBE) fiscal 4Q15 and fiscal 2015 performance. Adobe’s revenue grew 22% to reach $1.3 billion in fiscal 4Q15, but it was net income that attracted a lot of attention. Adobe’s net income grew a whopping 153% to $222 million in the quarter.

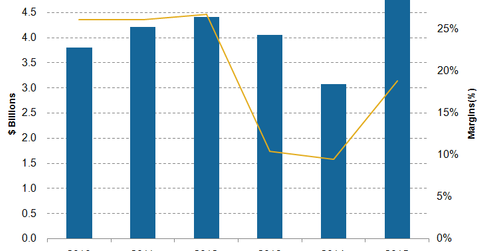

Adobe’s operating margin almost doubled from ~9.5% in fiscal 2014 to 18.8% in fiscal 2015, as you can see in the graph below. A reduction in operating expenses, primarily sales and marketing (or S&M) and general and administrative (or G&A) expenses, led to an expansion in Adobe’s margins. S&M and G&A fell from 40% and 13%, respectively, in 2014 to 35% and 11%, respectively, in 2015. For fiscal 2015, net income stood at $629 million on revenue of $4.5 billion.

Adobe was reeling under pressure of narrowing margins

There was a lot of confusion and uncertainty in the market about Adobe stock when the company decided to change to a subscription model. Adobe had been under pressure for margin shrinkage. Although the company has decent cash reserves and low debt, its margins remained a source of concern. Lower margins translate to a strong likelihood that a company will assume debt to fund share buybacks, which has become a sort of trend in the technology industry.

In April 2015, Oracle (ORCL) issued six-part $10 billion notes to fund its dividends and share buybacks. Microsoft (MSFT) and Qualcomm (QCOM) are some leading technology players that have resorted to bond sales to finance their share buybacks and dividends in 2015. Deals by Microsoft, Qualcomm, and AT&T (T) have flooded the debt market, which has pushed US corporate bond sales to the highest levels on record.

If Adobe’s recent revenues and improvement in operating margins are anything to go by, Adobe shows a lot of potential, as you can see in the above graph.

Investors who want to gain exposure to Adobe can consider investing in the Technology Select Sector SPDR ETF (XLK). XLK has an exposure of ~37% to application software and invests ~1% of its holdings in Adobe.