American Express Is Focusing on Its Global Commercial Services

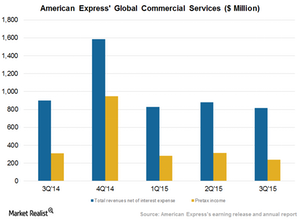

American Express’s Global Commercial Services’ total revenues net of interest expense fell by 9% to $817 million in 3Q15, forming 10% of its total revenues.

Dec. 11 2015, Updated 11:06 a.m. ET

International partnerships

American Express’s (AXP) Global Commercial Services division offers global corporate payment services to large and mid-sized companies. These services include expense management and travel services to companies and organizations around the world through the Global Corporate Payments and Global Business Travel businesses.

The company has increased its spending for the division in order to garner international partnerships and make up for higher competition in the United States.

Lower discount revenue

Global Commercial Services’ total revenues net of interest expense fell by 9% to $817 million in 3Q15, forming 10% of the company’s total revenues, as compared to $900 million in 3Q14.

Revenues fell by 5% on a constant dollar basis, mainly due to last year’s gain on the sale of investment securities and lower discount revenue. Net income for the division fell by 26% to $151 million as compared to $204 million in the prior year’s quarter. The division’s profitability fell largely due to the strong US dollar.

The division also offers corporate cards and corporate meeting cards, which are issued to individuals through a corporate account established by employers. The Global Commercial Services division offers a suite of business-to-business payment solutions, including a corporate purchasing card, which is an account established by companies to pay for everyday and large-ticket business expenses.

Expenditure on initiatives

Total expenses for the Global Commercial Services division stood at $541 million in 3Q15 as compared to $542 million in 3Q14. The company continued to spend on technology development in order to support growth initiatives. Total billed business for the division fell by 3% and rose by 1% on a constant dollar basis.

American Express achieved operating profit margins of 25% in the last fiscal year. Here’s how some of American Express’s peers in the payment-processing industry fared with their operating margins in the last fiscal year:

Together, these companies account for 1.9% of the iShares Core S&P 500 ETF (IVV).