Rationale for the Starwood-Marriott Merger

With the Starwood-Marriott merger, the companies expect to generate at least $200 million in annual cost savings beginning in the second year after the deal closes.

Nov. 20 2020, Updated 11:01 a.m. ET

The sale is the culmination of a process by Starwood

Bedeviled by difficulties in growing RevPAR (revenue per average room), Starwood Hotels & Resorts (HOT) began a process of examining strategic alternatives. It retained bankers, auctioned off the company, and found a buyer for its time-share business, which is being sold for approximately $1.5 billion to Interval Leisure Group (IILG). The Starwood-Marriott merger is the culmination of this process.

In some ways, this transaction is a sign that companies such as Airbnb are disrupting the industry and companies must merge to cut costs. This transaction is being driven by cost synergies, as well.

Comments from management

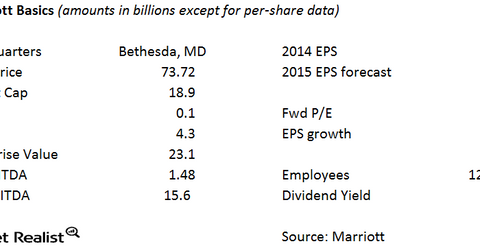

Arne Sorenson, president and chief executive officer of Marriott International (MAR), had this to say: “The driving force behind this transaction is growth. This is an opportunity to create value by combining the distribution and strengths of Marriott and Starwood, enhancing our competitiveness in a quickly evolving marketplace. This greater scale should offer a wider choice of brands to consumers, improve economics to owners and franchisees, increase unit growth and enhance long-term value to shareholders. Today is the start of an incredible journey for our two companies. We expect to benefit from the best talent from both companies as we position ourselves for the future. I know we’ll do great things together as The World’s Favorite Travel Company.”

Synergy estimates

By leveraging operating efficiencies, the companies expect to generate at least $200 million in annual cost savings beginning in the second year after the deal closes. Marriott expects the transaction to be accretive to earnings in the second year after closing, excluding transaction costs.

Other merger arbitrage resources

Other important merger spreads include the merger between Cigna Corporation (CI) and Anthem (ANTM), which is set to close at the end of 2016. For a primer on risk arbitrage investing, read Merger Arbitrage Must-Knows: A Key Guide for Investors.

Investors who are interested in trading in the hotel sector can look at the PowerShares Dynamic Leisure and Entertainment Portfolio (PEJ).