Why Preferred Stocks Are Less Volatile than Common Equities

Preferred stocks are less volatile compared to common equities. This is mainly because a larger portion of the returns comes from dividends, which tend to be stable.

Nov. 11 2015, Updated 12:07 a.m. ET

3. Lower volatility. Because preferred stocks have a fixed dividend and may not fluctuate the way common stocks do when the market changes, they can potentially reduce the overall volatility of an equity or high yield portfolio. Keep in mind, however, that preferred stocks are more volatile than traditional fixed income and can carry more risk when financial sectors are under pressure.

Market Realist – Preferred stocks are less volatile compared to common equities.

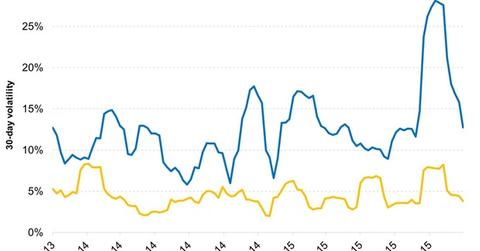

The graph above compares the 30-day volatility of the S&P 500 Index (IVV)(RSP) with that of the iShares US Preferred Stocks ETF (PFF). The 30-day volatility calculates the annualized standard deviation of the relative price movements in the last 30 days, expressed in percentage.

As you can see in the graph, preferred stocks tend to be less volatile (VXX) than common equities. This is mainly because a larger portion of the returns comes from dividends, which tend to be stable. In September, Wells Fargo (WFC) announced its plans to offer $1 billion in preferred shares with a 6% perpetual coupon. This is much higher than the 2.7% dividend yield that the company’s common stock is offering. However, preferred stocks are more volatile than bonds (LQD), as they are part-equity after all.

Unlike in the case of common stocks, companies are obligated to pay their preferred shareholders first, even in the event of a bankruptcy. If you only own common equities, you are last in the pecking order. Many companies issue both common stock preferred shares, which receive preferential treatment, and also own debt, which needs to be serviced first.

Read on to find out why preferred stocks underperform when the financial sector is at risk and why higher interest rates may not affect them much.