When Are Preferred Shares Appropriate for Your Portfolio?

Treasuries (TLO) add ballast to a stock-centric portfolio while providing low yields.

Nov. 6 2015, Published 3:32 p.m. ET

When preferred shares would be appropriate

Preferred stocks may be most appropriate in a portfolio that is looking to achieve the following objectives:

1.According to Bloomberg, preferred stocks have historically experienced the highest yields in the investment grade universe, which makes them an attractive alternative or complement to corporate, municipal, and high yield debt securities.

2. Diversification. Preferred stocks have lower historical correlations to traditional stocks and bonds, which means they tend to move in different directions when market conditions change.

Market Realist – Preferred shares add diversification benefits to a portfolio containing only stocks and bonds.

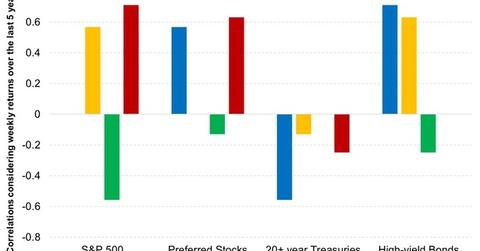

The graph above shows the correlations among the S&P 500 Index (IVV)(RSP), preferred stocks as tracked by the iShares US Preferred Stocks ETF (PFF), long-dated Treasuries (TLT), and high yield bonds (HYG), considering weekly returns in the past five years.

Much is said about the diversification benefits of adding bonds to a stock-centric portfolio, and with good reason. The correlation between the S&P 500 and long-dated bonds over the last five years has been -0.56, meaning the two tend to move in opposite directions. Treasuries (TLO) add ballast to a stock-centric portfolio while providing low yields.

However, adding preferred stocks to the mix seems to be beneficial. The correlation between preferred stocks and the S&P 500 over the last five years has been +0.57, which is relatively low compared to that between the S&P 500 and high yield bonds, which is +0.71. The correlation between preferred stocks and long-dated Treasuries in the same period was -0.13. In other words, preferred stocks move differently compared to stocks while having a slightly inverse relationship with long-dated Treasuries.

Preferred stocks also give a much higher yield compared to common stocks. The S&P 500 Index has a dividend yield of 2.1% while preferred shares have a coupon rate of ~5.5%.