An Overview of AvalonBay Communities’ Geographic Coverage

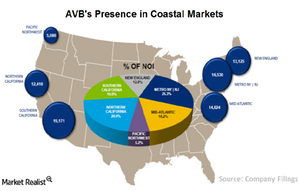

The distribution of properties in attractive US coastal markets reflects AvalonBay Communities’ geographic diversification strategy.

Oct. 5 2015, Updated 9:08 a.m. ET

Focus on coastal markets

AvalonBay Communities (AVB) develops, redevelops, acquires, owns, and operates multi-family communities primarily in New England, the New York metropolitan area, the Mid-Atlantic, the Pacific Northwest, as well as Northern and Southern California.

AvalonBay Communities focuses on leading metropolitan areas in these regions, characterized by growing employment in high wage sectors of the economy, lower housing affordability, and a diverse and vibrant quality of life. AvalonBay Communities believes that these market characteristics offer an opportunity for superior risk-adjusted returns on investments relative to other markets.

Presence in 11 states

As of January 2015, the company owned or held a direct or indirect ownership interest in 252 operating apartment communities containing 74,240 apartment homes in 11 states and the District of Columbia. Southern California comprised 23.1% of the company’s total apartment homes as of January 2015, followed by the New York Metro market with a share of 20.6%, then the Mid-Atlantic with 17.9%, and finally Northern California with 16.1%. On the other hand, non-core markets only comprised 1.7% of the total apartment homes as of January 2015.

Portfolio diversification

The distribution of properties in the attractive coastal markets of the US reflects AvalonBay Communities’ geographic diversification strategy, designed to take advantage of the growth in prime regional markets. Other major players in the apartment REITs such as Equity Residential (EQR), Essex Property Trust (ESS), and UDR (UDR) are also following the same portfolio diversification strategy. The iShares U.S. Real Estate ETF (IYR) invests 2.78% of its portfolio in AvalonBay Communities.

We will explore AvalonBay Communities’ major brands in the next part of this series.