Why Is Schlumberger’s Free Cash Flow So Remarkable?

In this part of the series, we’ll take a look at free cash flow for Schlumberger (SLB), Halliburton (HAL), Baker Hughes (BHI), and FMC Technologies (FTI).

Aug. 10 2016, Updated 11:04 a.m. ET

Comparing free cash flows

In this part of the series, we’ll take a look at free cash flow (or FCF) for Schlumberger (SLB), Halliburton (HAL), Baker Hughes (BHI), and FMC Technologies (FTI). These are the four prominent names in the oilfield services (or OFS) space we’ve been analyzing in this series.

FCF is defined as cash flow from operations (or CFO) less capital expenditure (or capex).

BHI is the 2Q16 FCF leader

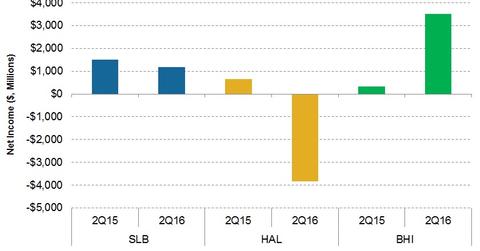

Baker Hughes’s fiscal 2Q16 FCF improved significantly over the previous year, primarily due to a $3.5 billion merger termination payment it received from Halliburton (HAL) following its merger termination in May 2016. Its CFO increased significantly due to this lump sum payment, compared to a $581 million CFO in the corresponding quarter last year.

BHI’s capex also fell sharply in fiscal 2Q16, leading to a sharp FCF improvement during the same period. Read the previous part to know how much these companies plan to spend in capital investments in fiscal 2016. BHI makes up 1% of the iShares Global Energy ETF (IXC).

SLB’s FCF was positive in 2Q16

Schlumberger recorded positive FCF in fiscal 2Q16 at ~$1.2 million, or 21% lower than fiscal 2Q15. The company’s fiscal 2Q16 CFO also declined 21% from fiscal 2Q15 due primarily to lower revenue. Its capex fell 23.5%. Lower CFO more than offset the fall in capex, which led to lower FCF in the most recent quarter.

FTI’s and HAL’s FCF declines

FMC Technologies’ FCF for fiscal 2Q16 decreased to -$36 million from -$14 million a year ago. FTI’s CFO turned negative in fiscal 2Q16 over fiscal 2Q15, led by lower revenues.

FTI’s capex fell 57% during the same period. However, lower capex couldn’t offset the falling CFO, which led to lower FCF. FTI is 0.2% of the iShares Russell Mid-Cap Value ETF (IWS). The energy sector makes up 9.2% of IWS.

Halliburton’s fiscal 2Q16 FCF was -$3.8 billion compared to $664 million in fiscal 2Q15. From fiscal 2Q15 to fiscal 2Q16, its CFO also turned negative due to sharply lower revenues and the merger-related payment. Lower CFO more than offset a 59% capex fall, leading to its FCF crash.

In the following part, we’ll take a look at these companies’ indebtedness.