Overview of Motorola Solutions

Motorola Solutions has a market capitalization of $14.21 billion, and competitors Harris Corporation and Cisco have market capitalizations of $9.37 billion and $131.29 billion, respectively.

Nov. 20 2020, Updated 4:19 p.m. ET

Motorola—an industry leader

Motorola Solutions (MSI) is an American-based multinational company in the data communications and telecommunications segment that succeeded Motorola, Inc., after the spin-off of the mobile phone division into Motorola Mobility in 2011. The company is headquartered in Schaumburg, Illinois, and has more than 100,000 public safety and commercial customers across 100 countries.

As an industry leader, Motorola Solutions designs and develops devices including radios and the infrastructure that supports them. Working with its global channel partner community, Motorola Solutions reaches an extensive customer base, from small businesses to Fortune 500 companies. The focus of the firm is on developing integrated end-to-end solutions that deliver a clear return on investment.

Main competitors of Motorola Solutions include Harris Corporation (HRS), Cisco Systems (CSCO), and Honeywell International (HON). Motorola has a market capitalization of $14.21 billion, and Harris Corporation and Cisco have market capitalizations of $9.37 billion and $131.29 billion, respectively.

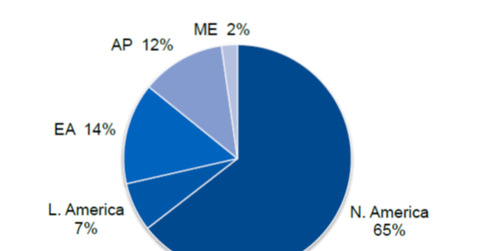

Revenues from international markets

In the above chart, we can see that Motorola is a truly global company and generates substantial revenues from international markets. In 2Q15, Motorola generated 65% of its revenue from North America, 7% from Latin America, 14% from Europe and Africa, 12% from the Asia-Pacific region, and 2% from the Middle East.

You can gain exposure to Motorola Solutions by investing in the Technology Select Sector SPDR Fund (XLK) and the iShares U.S. tech ETF (IYW). Motorola accounts for 0.35% of XLK and 0.39% of IYW.