How Does Keysight Technologies Compare to Its Peers?

The Guggenheim Spin-Off ETF (CSD) invests 5.0% of its holdings in Keysight Technologies.

Nov. 20 2020, Updated 11:29 a.m. ET

Keysight Technologies and its peers

In this article, we’ll compare Keysight with its peers:

- The PE (price-to-earnings) ratios of Keysight Technologies (KEYS), Ametek (AME), National Instruments (NATI), and Teradyne (TER) are 15.7x, 22.4x, 36.7x, and 41.9x, respectively, as of November 19, 2015.

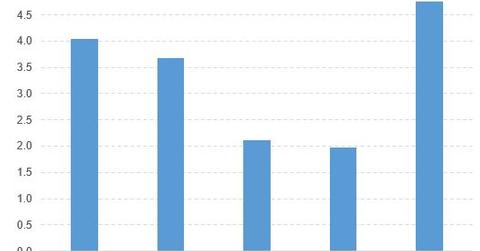

- The PBV (price-to-book value) ratios of Keysight, Ametek, National Instruments, Teradyne, and Viavi Solutions (VIAV) are 4.8x, 4.0x, 3.7x, 2.1x, and 2.0x, respectively.

According to the above findings, the company’s peers are ahead of Keysight Technologies based on PE. However, Keysight Technologies has outperformed its peers based on PBV.

ETFs that invest in Keysight Technologies

The Guggenheim Spin-Off ETF (CSD) invests 5.0% of its holdings in Keysight. The ETF tracks an index of US-listed stocks spun off from corporate parents over the past 30 months. The index holds companies of all sizes.

The Guggenheim Mid-Cap Core ETF (CZA) invests 0.76% of its holdings in Keysight. The ETF tracks the Zacks Mid-Cap Core Index, a proprietary-selected portfolio of 100 mid-cap stocks that seeks to outperform pure market cap indexes.

The First Trust US IPO (FPX) invests 0.49% of its holdings in Keysight. The ETF tracks a market-cap-weighted index of the 100 largest US IPOs over the first 1,000 trading days of each stock. Stocks must pass additional quantitative screens to make it into the index.

Comparing Keysight Technologies and its ETFs

Now let’s compare Keysight with the ETFs that invest in it:

- The year-to-date price movements of Keysight, CSD, CZA, and FPX are -7.8%, -9.0%, 0.02%, and 4.6%, respectively.

- The PE ratios of Keysight, CSD, CZA, and FPX are 15.7x, 21.8x, 19.3x, and 29.4x, respectively.

- The PBV ratios of Keysight, CSD, CZA, and FPX are 4.8x, 1.7x, 1.9x, and 3.6x, respectively.

According to the above findings, these ETFs are ahead of Keysight Technologies based on price movement and PE. However, Keysight Technologies has outperformed its ETFs based on PBV.