What You Should Know about FEAAX

FEAAX has existed since March 1994 and has an expense ratio of 1.4%. You require a minimum of $2,500 to invest in this fund via Class A shares

March 7 2016, Published 4:56 p.m. ET

Fidelity Advisor Emerging Asia Fund

The Fidelity Advisor Emerging Asia Fund (FEAAX) aims to invest 80% of its net assets in “securities of Asian emerging market issuers and other investments that are tied economically to Asian emerging markets.” The fund is managed by Colin Chickles.

The fund manager uses a combination of bottom-up and top-down research by applying fundamental analysis on each issuer’s financial condition and industry position, as well as market and economic conditions, while constructing the portfolio.

Portfolio composition

As stated in the fund literature, financials were the single-largest sectoral holding of the fund and formed 30.9% of its portfolio as of January 2016. The information technology and consumer discretionary sectors, in that order, were second and third.

Compared to the MSCI AC Asia ex Japan Index, FEAAX is overweight in the consumer discretionary, utilities, and energy sectors. On the other hand, it’s underweight in the industrials and healthcare sectors. Its allocation to other sectors is broadly in-line with that of its benchmark.

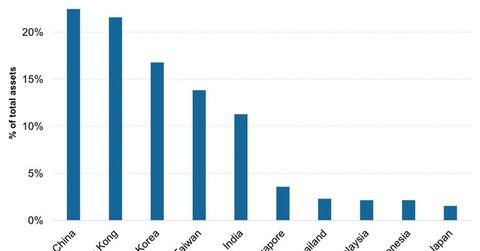

China was FEAAX’s biggest invested geography in January 2016, making up over one-fifth of the fund’s assets. Hong Kong followed closely, making up 21.6% of the fund’s January portfolio. Stocks from South Korea, Taiwan, and India rounded off the top five invested geographies.

Compared to the index mentioned above, the fund is overweight in Chinese and Indian equities, while being underweight in South Korean, Taiwanese, Singaporean, Malaysian, and Indonesian equities. Unlike most other funds in this review, FEAAX isn’t invested in Australian equities and has a very small exposure to Japanese stocks, even though the benchmark doesn’t.

H shares of China Telecommunications (CHA), SK Telecom (SKM), TAL Education Group (XRS), New Oriental Education & Technology Group (EDU), and Shinhan Financial Group Company (SHG) were among the fund’s 223 holdings as of December’s end 2015. As of February 2016, the fund was managing assets worth $213.8 million.

Fee and minimums

FEAAX has existed since March 1994 and has an expense ratio of 1.4%. You require a minimum of $2,500 to invest in this fund via Class A shares, and the fund can charge a maximum sales charge of 5.8% of the offering price. A redemption fee of 1.5% of the amount redeemed is levied if investments are redeemed within 90 days.

In the next article, we’ll look at some of the key metrics of the fund’s performance in the one-year period ended February 2016.