China Telecom Corporation

Latest China Telecom Corporation News and Updates

Technology & Communications Why Chinese carriers cutting smartphone subsidies affects Apple

China’s telecom providers, China Mobile (CHL), China Unicom (CHU), and China Telecom (CHA), had started to sell the iPhone 5S at a subsidized price. However, it seems the Chinese government wants to nip this trend in the bud itself.

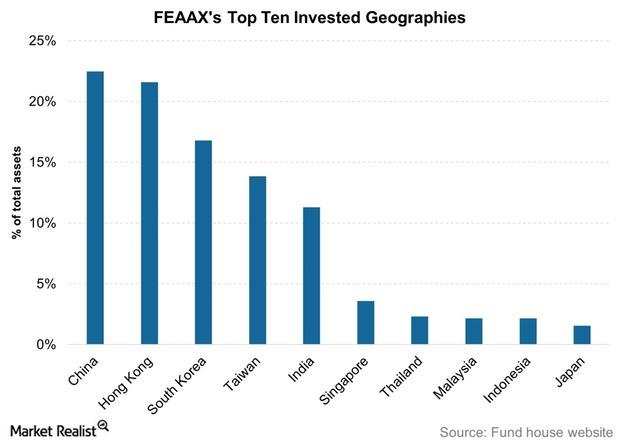

What You Should Know about FEAAX

FEAAX has existed since March 1994 and has an expense ratio of 1.4%. You require a minimum of $2,500 to invest in this fund via Class A shares