Starbucks’ Key Segments for Its 4Q15 Earnings

Starbucks (SBUX) operates restaurants in 65 countries around the world. However, 83% of its revenue comes from the Americas and the CAP segments.

Oct. 26 2015, Updated 2:43 p.m. ET

Starbucks’ key segments

Starbucks (SBUX) operates restaurants in 65 countries around the world. However, 83% of its revenue comes from the Americas and the CAP (China/Asia-Pacific) segments. The main countries in the Americas segment include the US, Mexico, and Canada. The main countries in the CAP segment include China, Japan, South Korea, and Taiwan.

Americas segment

- The Americas segment contributed 69%, or $3.4 billion, towards Starbucks’ revenue. It contributed 72%, or $855 million, towards Starbucks’ operating income in 3Q15.

- In terms of size, the US market is the biggest. It has almost 84% of the locations in the US.

- This makes the company sensitive to economic activities in the US.

- Consumer conditions in the US have been strong. With the federal funds rate still at its lowest level, strength in the job markets with unemployment rates at 5.1%, and the recent consumer confidence at 103, Starbucks stands to gain from these factors.

This is also positive for restaurant companies that mainly operate in the US like Chipotle (CMG), Darden Restaurants (DRI), and Shake Shack (SHAK). The iShares Global Consumer Discretionary (RXI) holds ~7% of restaurant stocks. It also benefited.

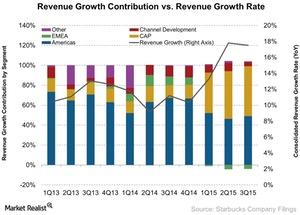

Until recently, the Americas segment was the largest contributor towards Starbucks’ revenue growth. You can see this in the above chart. The company acquired all of its locations in Japan. This made the CAP segment equally important.

CAP segment

- The CAP segment contributed 13%, or $652 million, towards Starbucks’ revenue. It contributed about 13%, or $150 million, towards the company’s operating income in 3Q15.

- The most important market in this segment is China. It’s the company with the most locations.

- This market may dampen Starbucks’ 3Q15 results because of the negative factors that played out in the region.

- The negative factors include the stock market bubble bursting in August and the currency devaluation around the same time.

- The US dollar has strengthened against most of the currencies. Weaker foreign exchange rates could also be negative during 4Q15.

Next, we’ll look at the same-store sales growth in the Americas segment and the CAP segment.