Natural Gas Weighed Heavily on Peabody Energy’s US Shipments

Peabody Energy’s (BTU) US operations sold 45.7 million tons of thermal coal (KOL) in 3Q15, 5.2% lower than 3Q14’s 48.2 million tons.

Oct. 29 2015, Published 3:35 p.m. ET

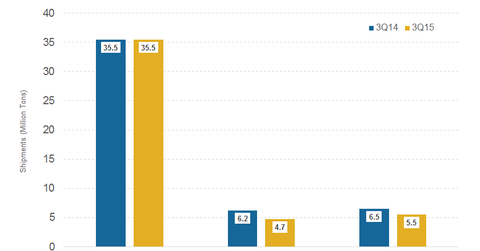

Peabody Energy’s US shipments

Peabody Energy’s (BTU) US operations sold 45.7 million tons of thermal coal (KOL) in 3Q15, 5.2% lower than 3Q14’s 48.2 million tons.

Midwest volumes dropped to 5.5 million tons in 3Q15 from 6.5 million tons in 3Q14, as increased switching to natural gas weighed heavily on coal in the region. Illinois Basin coal is trading at a multi-year low due to fierce competition from natural gas.

Western mining operations saw shipments dropping to 4.7 million tons in 3Q15 from 6.2 million tons in 3Q14. The drop in shipments was due to weak natural gas prices, reduced volumes from Twentymile mine in Colorado, and planned movement of mining equipment. Powder River Basin coal shipments remained steady at 35.5 million tons.

Australian shipments

Australian metallurgical coal (used in steelmaking) shipments dropped to 4.0 million tons in 3Q15 from 4.5 million tons in 3Q14. The company closed one mine in late-2014 and reduced production at one of the Australian mines, which led to the fall in met coal shipments from Australia. A supply glut in the global metallurgical coal market continued to hamper Peabody Energy and other producers including Rio Tinto (RIO) and BHP Billiton (BHP). Two major American met coal producers, Alpha Natural Resources and Walter Energy, filed for bankruptcy during 3Q15.

Australian thermal coal shipments came in at 5.3 million tons, 0.2 million tons lower than in 3Q14. Overall, Peabody Energy sold 58.4 million tons of coal in 3Q15 including trading and brokerage shipments, down from 62.5 million tons in 3Q14.