What Has Muted the Demand for Commodities?

The demand for commodities has been dampened by a variety of factors, particularly in the last two years.

Nov. 20 2020, Updated 11:15 a.m. ET

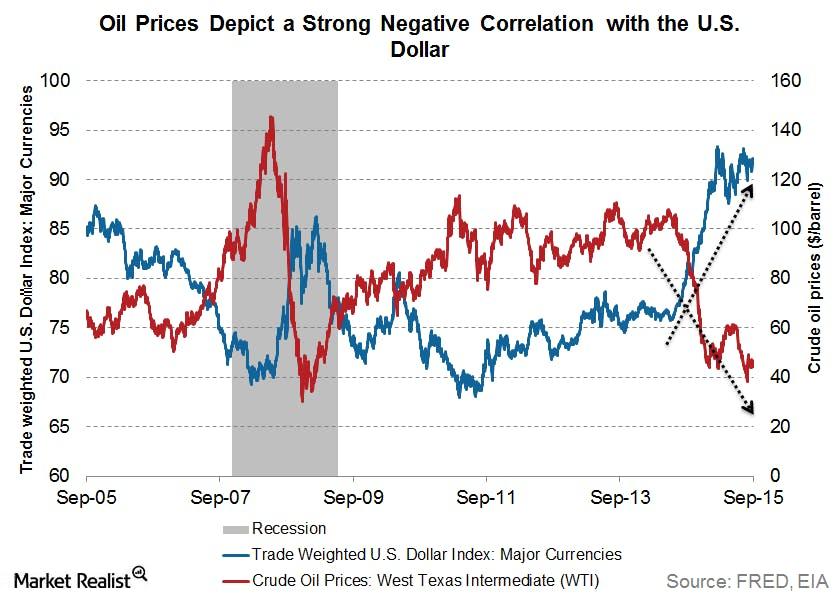

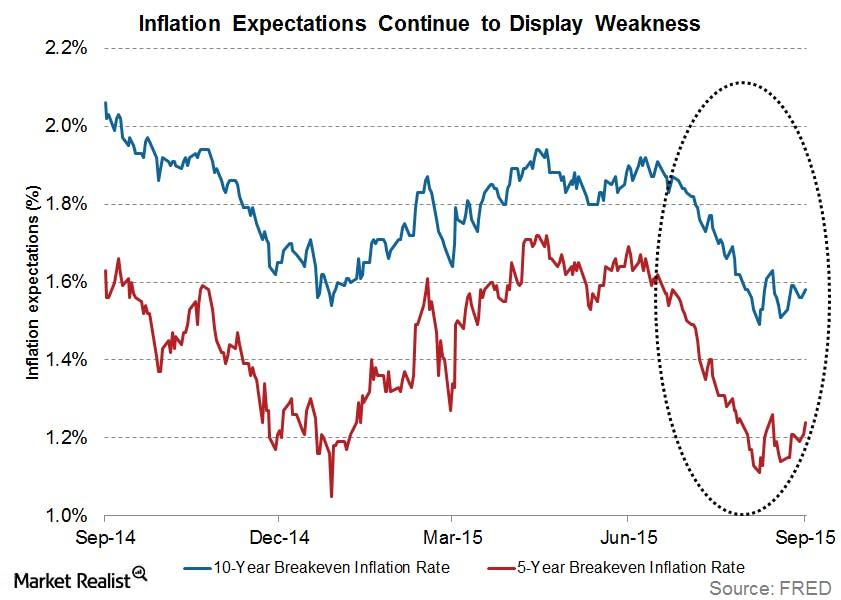

Demand has suffered as global growth has slowed, particularly from commodity-intensive emerging markets. Slower global growth has also been associated with a severe drop in inflation expectations. Since commodities are viewed as a hedge against inflation, this drop has led to a collapse in investor demand. In addition, commodities have struggled under the weight of a stronger dollar, a trend likely to continue given long-term global trends such as divergent monetary policies. Dollar bull markets typically last six to seven years.

Market Realist – Factors causing muted demand for commodities

The commodities conundrum ultimately boils down to the economic forces of demand and supply. The world production of commodities has picked up pace over the last decade. On the other hand, the demand for commodities has been dampened by a variety of factors, particularly in the last two years. The following are some of the major factors that have caused muted demand for commodities:

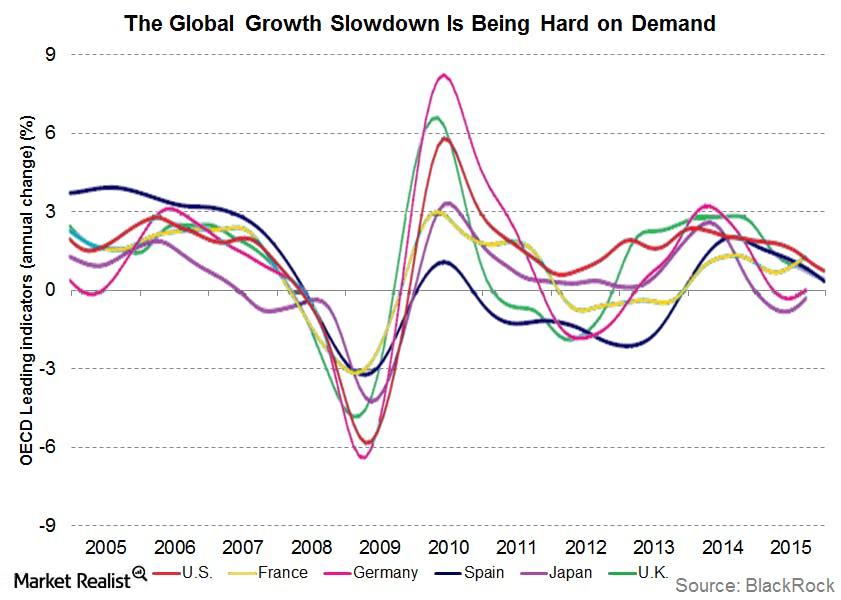

- Over the past few years, the growth in developed economies has been sluggish, to say the least. The Eurozone (IEV) has only started to lift itself out of its double-dip recession in the past year. Much of that growth can be attributed to the quantitative easing efforts of the European Central Bank. According to Bloomberg, the US has been growing at an average annual rate of 2.2% in the post-recession period. This looks decent compared to the rest of the developed world (EFA). However, it is still lower than the historical averages for growth in a recovery phase.

- The International Monetary Fund (or IMF) has again lowered the global growth forecast in its October World Economic Outlook. The IMF estimates that global growth will come in at 3.1% in 2015 and 3.6% in 2016. This is lower than its previous estimates of 3.3% and 3.8%, respectively. The previous graph shows how the OECD leading indicator index seems to be trending downwards for most of the developed nations.

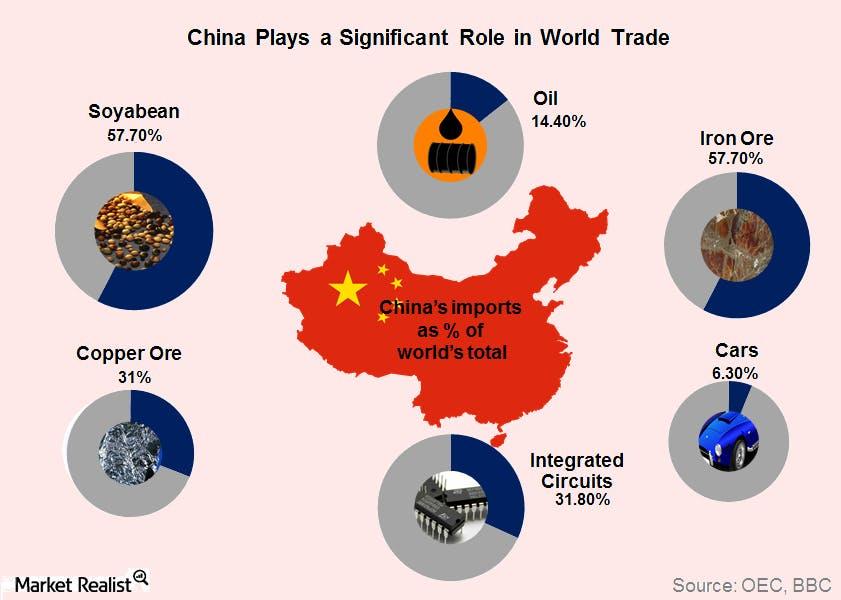

- In recent years, emerging markets (IEMG) (DEM) have been the drivers of global growth. However, with signs of slowdown in the Chinese economy, this might not be the case going ahead. In fact, the slowdown in China (ASHR) is largely responsible for the muted demand for commodities. China is responsible for 14% of the world’s oil imports, 58% of the world’s soybean imports, and 58% of the world’s iron ore imports, as the above graph shows. The slowdown in China is a major contributor to the negative sentiment for commodities.

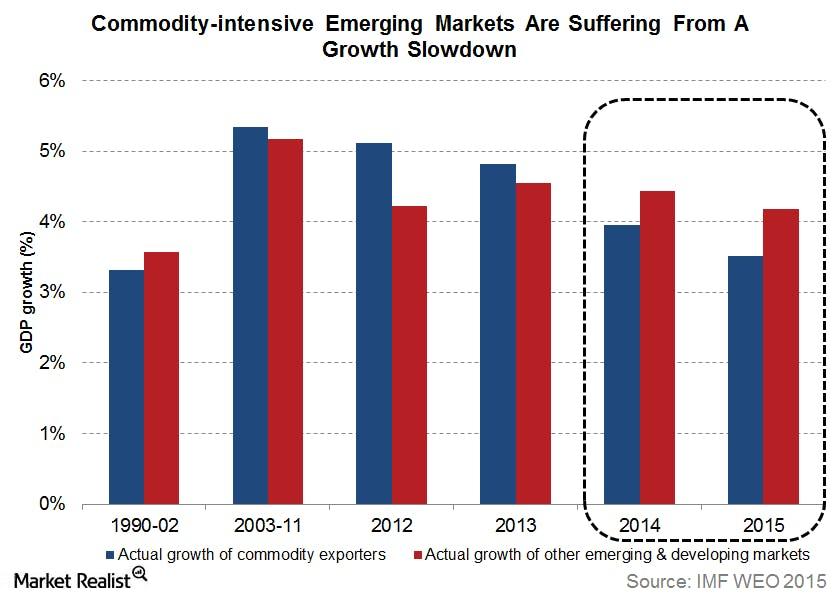

- The previous graph shows how commodity-intensive emerging markets (EEM) are underperforming other emerging markets (VWO) in terms of GDP growth. Muted demand for commodities is leading to lower prices. This in turn is hurting the growth of commodity exporters, effectively contributing to the global growth slowdown, and thus, lower commodity demand. It is indeed a vicious cycle.

- The strength of the US dollar (UUP) is also affecting demand for commodities. Most commodities are priced in US dollars and thus are negatively related to dollar fluctuations. This means that a rise in the dollar leads to a fall in commodity prices and vice versa. The negative relation between crude oil prices (DBO) and the trade-weighted dollar index can be seen in the previous graph.

- Most of the commodities like gold (IAU) (GLD) and silver (SLV) are considered to hedge against inflation. However, core inflation continues to languish way below the Fed’s target of 2% while market inflation expectations continue to remain low. This is also contributing to lower demand for commodities.