Lower Shipments and Pricing Hampered Peabody’s 3Q15 Revenues

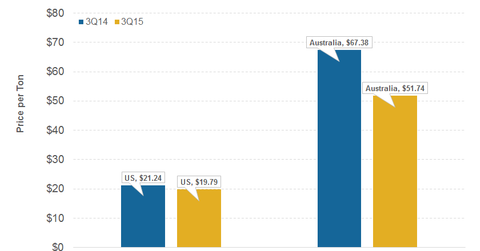

Peabody Energy’s (BTU) US operations posted revenue per ton of $19.79 in 3Q15, down from $21.24 in 3Q14.

Nov. 2 2015, Updated 3:07 p.m. ET

Peabody Energy’s 3Q15 revenues

Peabody Energy’s (BTU) US operations posted revenue per ton of $19.79 in 3Q15, down from $21.24 in 3Q14. This dip follows persistent pressure on thermal coal prices due to low natural gas prices as well as regulatory issues.

Western operations’ revenue per ton was down to $37.67 in 3Q15 from $38.55 in 3Q14. The Midwest revenue per ton saw a significant drop to $45.79 in 3Q15, compared to $47.88 in the corresponding quarter in 2014. The Midwest pricing is strongly driven by natural gas prices. Illinois Basin coal is trading at multi-year lows.

Powder River Basin (or PRB) coal prices came in marginally higher at $13.42 a ton in 3Q15 compared to $13.30 in 3Q14. Cloud Peak Energy (CLD) reported a $0.50 drop in realized price per ton of PRB coal. Overall, US operations generated $901.7 million in revenues in 3Q15 compared to $1024.0 million in 3Q14.

Australian operations

Peabody Energy’s Australian operations reported $51.74 in realization per ton in 3Q15 compared to $67.38 a ton in 3Q14.

Australian metallurgical coal revenues dropped by over $20.0 a ton to $68.53 a ton while Australian thermal coal revenues dropped to $38.77 a ton in 3Q15 from $50.03 a ton in 3Q14.

Continued glut in the metallurgical coal (KOL) market, the slowdown in China, and the changing energy mix affected pricing and shipments from Australia. According to the management of the company, around 80% of the global seaborne met coal production is not even breaking even.

Overall revenues

Peabody Energy’s 3Q15 revenues came in at $1.4 billion in 3Q15, down from $1.7 billion in 3Q14.