How Hershey Gained from Improving Its Supply Chain

In 2010, Hershey announced Project Next Century, which aims to streamline its global supply chain operations and create a more competitive cost structure.

Nov. 1 2015, Updated 11:05 a.m. ET

A brief history of focus: supply versus demand

The Hershey Company (HSY) is a leader in the US confectionery market (XLP) (IYK), and with so many popular brands, Hershey didn’t previously have to worry much about consumer demand. So Hershey continued to expand its SKUs (stock keeping units) rapidly, thinking consumers would absorb everything the company put in its distribution. But over time, Hershey’s wide offering actually left the consumers in confusion—a single brand, with dozens of SKUs, with different types of chocolates, different flavors, different fillings, different packages and different sizes. Even retailers became uneasy carrying such a large range of inventory.

As such, prior to 2008, Hershey’s main focus was on expanding its offerings to its customers, but customers were not necessarily adapting to Hershey’s wide variety. So after Hershey felt the need to investigate its demand chain, it eventually transformed from a supply-driven model to a demand-driven model, focusing more on its core brands. With this new approach, the company could generate record cash flows in 2009 more than double its 2008 cash flows.

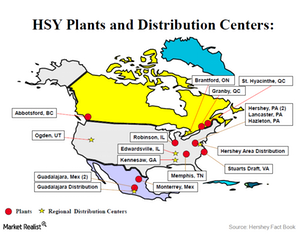

As of mid-2015, Hershey owned and operated 13 confectionery manufacturing plants in North America.

Project Next Century

In June 2010, Hershey announced its Project Next Century, which aims to streamline the company’s global supply chain operations and to create a more “competitive cost structure.” To reach this goal, the first step Hershey took was to change its supply chain design and analytics. Accordingly, Hershey appointed a vendor of supply chain design software, LLamasoft, which restructured Hershey’s supply chain, gearing it toward internal capability, with a high-level view of operations, which allowed Hershey to detect flaws in internal disciplines. In May 2014, LLamasoft introduced the Data Guru Application, which allows Hershey to “examine the impact of strategic decisions that are under consideration.”

LLamasoft’s customers include many renowned companies in different industries, including Nike (NKE) and McCormick & Comany (MKC). By December 2014, Llamasoft completed its program for Hershey, which cost $197.9 million. In 2014, Hershey’s North America segment reported a 2.9% increase in net income, driven by higher sales volume and improvements in supply chain operations.

Read the next part of this series for a look at other steps Hershey has taken in order to improve supplier productivity and conscious sourcing.