How CBL Plans to Increase Shareholder Returns

CBL’s (CBL) long-term strategy is to maximize shareholder returns while maintaining prudent risk profile.

Oct. 22 2015, Updated 11:07 a.m. ET

Strategic focus on shareholder returns

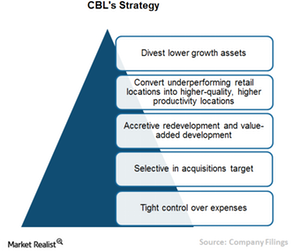

CBL & Associates Properties’ (CBL) long-term strategy is to maximize shareholder returns while maintaining a prudent risk profile. The company’s strategy focuses on the acquisition, leasing, management, development, and redevelopment of shopping centers.

Reinvestment strategy

A company’s reinvestment strategy is the cornerstone of creating a positive return for shareholders. CBL’s strategy involves redeploying the capital generated from the sale of non-core properties into high-income generating properties. The company continues to market properties for disposition. These properties are generally stable but the company does not see any growth potential for the properties. CBL expects this strategy will lead to a healthy properties portfolio that is built for future growth.

Portfolio transformation strategy

CBL aims to transform its portfolio with the addition of new uses to its properties. The company has contributed to this shift by re-imagining the components of its shopping centers. CBL’s properties now include offerings such as hotels, entertainment, dining options, and non-traditional anchors. To attract a wider segment of the population, its properties are being transformed into regional shopping and entertainment destinations, in contrast to the earlier concept of simple malls.

Strategy to generate higher returns

CBL (CBL) expects that its above strategy will help generate higher returns to shareholders, while maintaining a strong balance sheet in the years to come. The company’s strategy is also expected to help thwart competition from its peers like General Growth Properties (GGP), Taubman Centers (TCO), and Macerich (MAC). CBL (CBL) forms 0.2% of the SPDR Dow Jones Global Real Estate ETF (RWO).

In the next article, we’ll analyze CBL’s revenue.